The original consolidated financial statements included herein are in

Indonesian language.

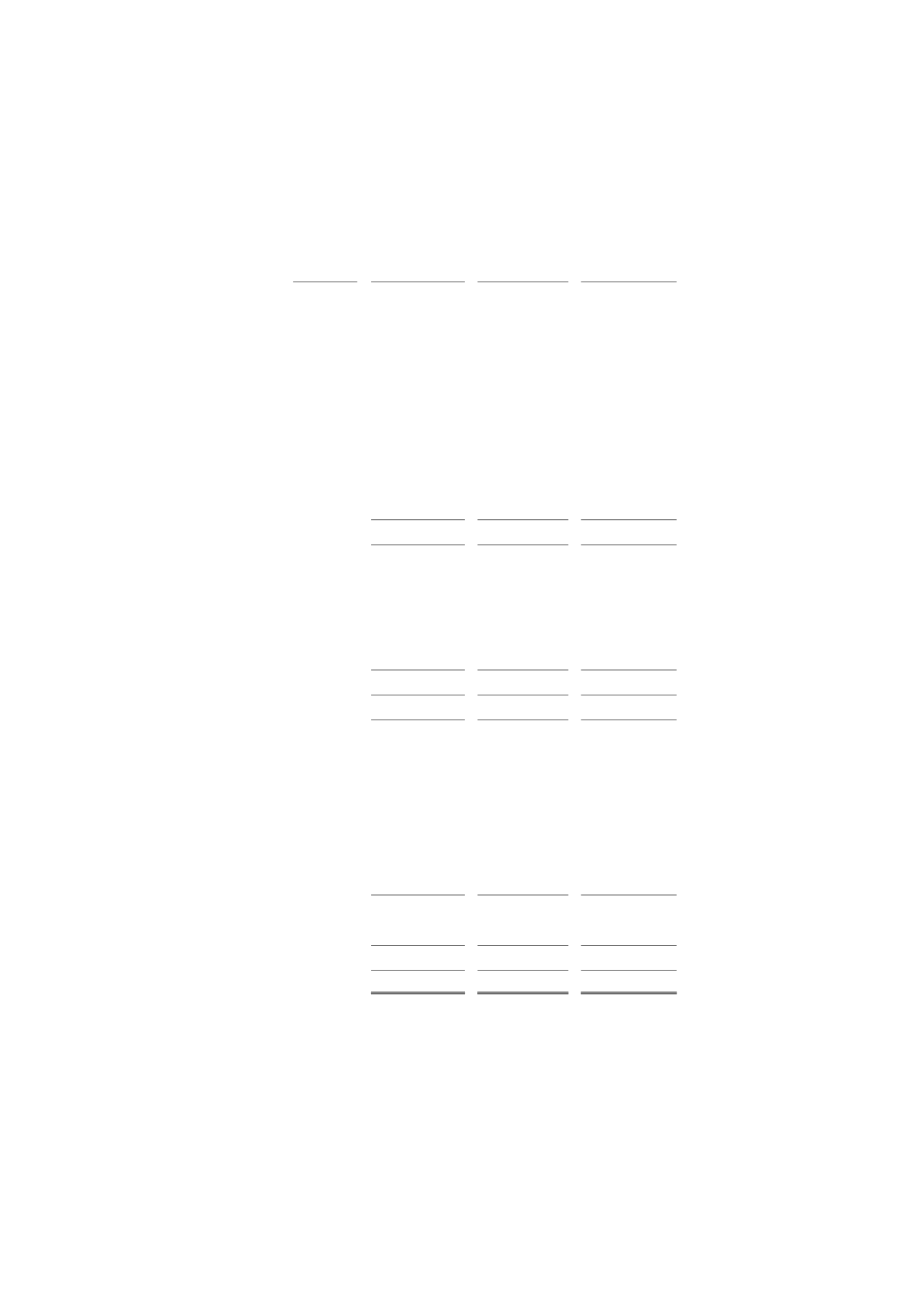

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

LAPORAN POSISI KEUANGAN

KONSOLIDASIAN (lanjutan)

31 Desember 2019 dan 2018

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION (continued)

December 31, 2019 and 2018

(Expressed in Rupiah, unless otherwise stated)

Catatan terlampir merupakan bagian yang tidak terpisahkan

dari laporan keuangan konsolidasian secara keseluruhan.

The accompanying notes form integral part of these

consolidated financial statements.

2

1 Januari 2018/

31 Desember 2017/

Catatan/

January 1, 2018/

Notes

2019

2018*

December 31, 2017

*

LIABILITAS DAN EKUITAS

LIABILITIES AND EQUITY

LIABILITAS JANGKA PENDEK

CURRENT LIABILITIES

Pinjaman bank jangka pendek

18 498.020.873.242 665.675.845.674 479.135.275.627

Short-term bank loans

Utang usaha

19

Trade payables

Pihak ketiga

618.844.195.405 674.479.236.967 640.327.607.177

Third parties

Pihak berelasi

3e 26.076.199.738 33.932.277.659

17.465.704.993

Related parties

Utang lain-lain

20 10.084.940.653 11.896.150.724

9.364.089.780

Other payables

Utang derivatif

3g,17b

-

15.071.429

10.669.582

Derivative payable

Utang pajak

3q,21c

8.823.531.906 12.912.044.563

23.468.404.442

Taxes payable

Biaya masih harus dibayar

22 13.237.160.241

8.005.417.419

11.505.410.269

Accrued liabilities

Provisi bonus

3n,22 15.887.236.513

8.256.057.932

12.355.564.967

Provision for bonuses

Uang muka pelanggan

23 72.215.588.257 77.230.108.198

62.583.787.495

Deposits from customers

Pinjaman jangka panjang jatuh

Current maturities of

tempo dalam waktu satu tahun

long-term loans

-

Utang bank

24

2.186.782.202

1.651.071.466

4.341.786.330

Bank loans -

-

Utang pembiayaan konsumen

25

415.860.479

315.225.862

309.917.823

Consumer financing payables -

- Utang sewa guna usaha

3m,26 19.024.351.886

3.033.418.106

-

Finance lease payable -

Total Liabilitas Jangka Pendek

1.284.816.720.522 1.497.401.925.999 1.260.868.218.485

Total Current Liabilities

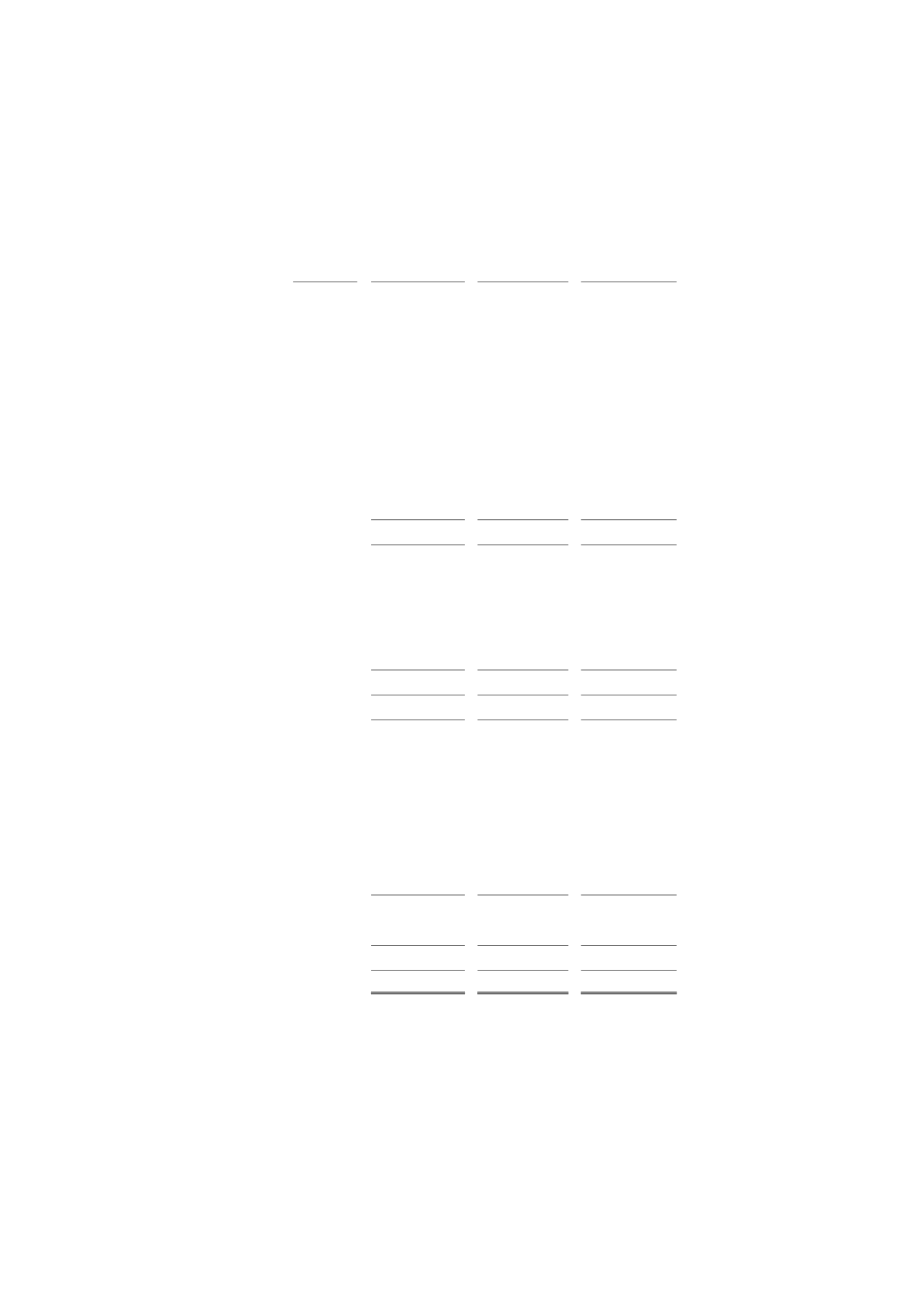

LIABILITAS JANGKA PANJANG

NON-CURRENT LIABILITIES

Pinjaman jangka panjang - setelah

dikurangi bagian jatuh tempo

Long-term loans - net of

dalam waktu satu tahun

current maturities

-

Utang bank

24 12.177.409.573 13.544.886.239

-

Bank loans -

- Utang pembiayaan konsumen

25

562.718.226

267.715.964

327.866.741

Consumer financing payables -

- Utang sewa guna usaha

3m,26 78.433.180.118 15.374.276.127

-

Finance lease payable –

Obligasi

27 500.000.000.000

-

-

Bonds

Liabilitas imbalan kerja

3p,28 42.333.944.981 36.164.150.905

34.848.104.976

Employees’ benefits liabilities

Total Liabilitas Jangka Panjang

633.507.252.898 65.351.029.235

35.175.971.717

Total Non-Current Liabilities

TOTAL LIABILITAS

1.918.323.973.420 1.562.752.955.234 1.296.044.190.202

TOTAL LIABILITIES

EKUITAS

EQUITY

Ekuitas yang dapat diatribusikan

Equity attributable to owners

kepada pemilik entitas induk

of the parent entity

Modal saham - nilai nominal

Common share capital - par value

Rp100 per saham

Rp100 per share

Modal dasar - 10.000.000.000 saham

Authorized-10,000,000,000 shares

Modal ditempatkan dan disetor penuh

Issued and fully paid

4.155.602.595 saham

3u,29 415.560.259.500 415.560.259.500 415.560.259.500

4,155,602,595 shares

Agio saham

940.000.000

940.000.000

940.000.000

Capital paid in excess of par value

Saldo laba

Retained earnings

Dicadangkan

30

5.000.000.000

4.000.000.000

4.000.000.000

Appropriated

Tidak dicadangkan

688.542.220.255 502.071.107.829 396.602.363.242

Unappropriated

Penghasilan komprehensif lain

(424.297.818)

58.255.447

(2.980.316.349)

Other comprehensive income

Jumlah ekuitas yang dapat

diatribusikan kepada:

Total equity attributable to:

Pemilik entitas induk

1.109.618.181.937 922.629.622.776

814.122.306.393

Owners of the parent entity

TOTAL EKUITAS

1.109.618.181.937 922.629.622.776

814.122.306.393

TOTAL EQUITY

TOTAL LIABILITAS DAN EKUITAS

3.027.942.155.357 2.485.382.578.010 2.110.166.496.595

TOTAL LIABILITIES AND EQUITY

*) Setelah reklasifikasi - Catatan 45 dan 46

*)

After reclassification - Notes 45 and 46