Analisis dan Pembahasan Manajemen

Management Discussion andAnalysis

PTVokselElectricTbk

LaporanTahunan 2017AnnualReport

76

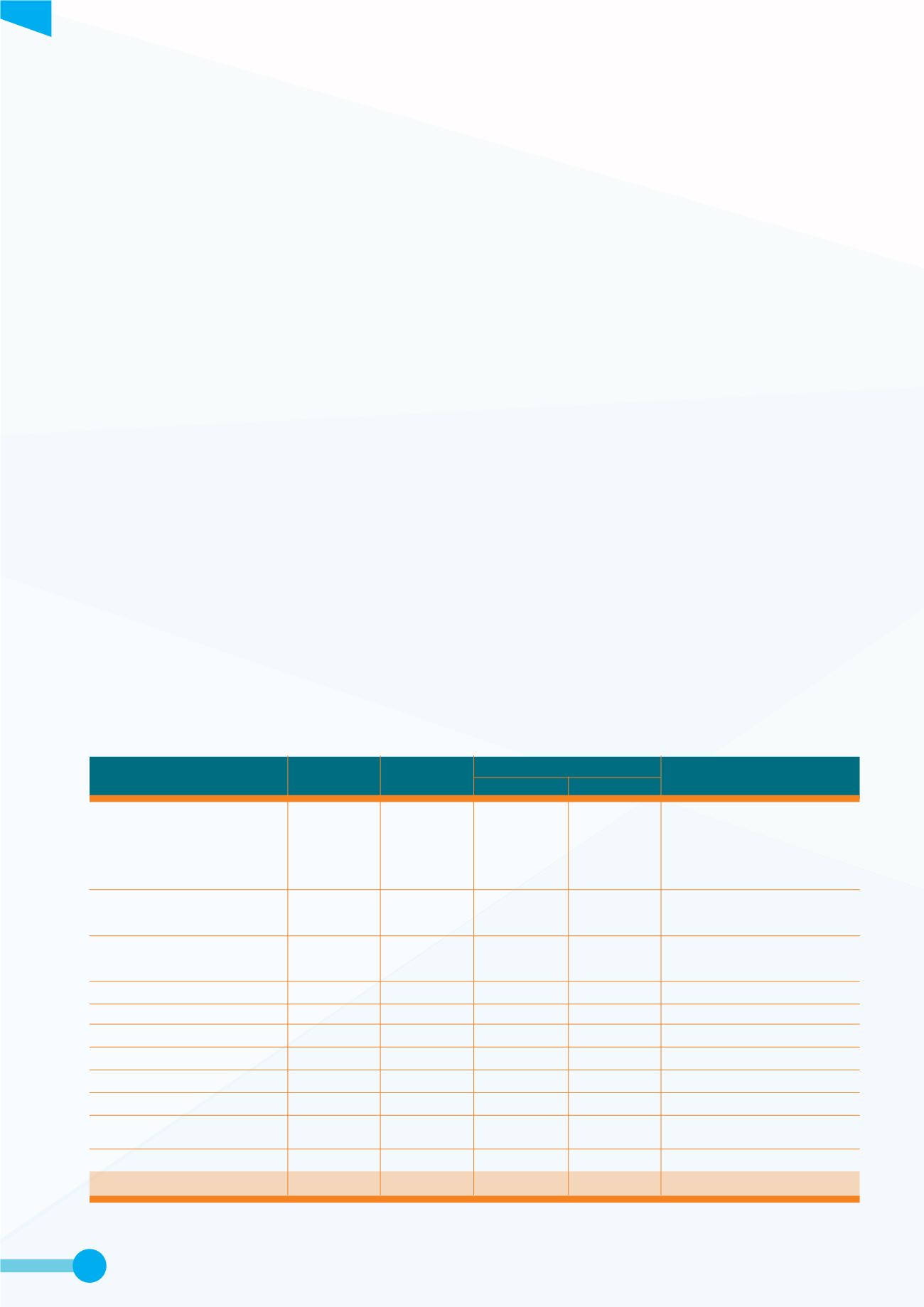

Uraian

Description

2016

Rp

%

2017

Ekuitas yang dapat diatribusikan

kepada pemilik entitas induk

Modal saham - nilai nominal Rp100

per saham di 2017 dan Rp500 per

saham di 2016

Modal Dasar - 10.000.000.000 saham

di 2017 dan 2.000.000.000 saham

di 2016

Modal ditempatkan dan disetor

penuh 4.155.602.595 saham di 2017

dan 831.120.519 saham di 2016

Agio Saham

Saldo Laba

- Dicadangkan

- Tidak Dicadangkan

Penghasilan Komprehensif Lain

Cadangan Lainnya

Jumlah Ekuitas Yang Dapat

Diatribusikan Kepada:

- Pemilik Entitas Induk

TOTAL EKUITAS

415,560.26

940.00

4,000.00

395,449.17

(2,980.32)

1,153.20

814,122.31

814,122.31

415,560.26

940.00

3,000.00

246,866.62

1,523.48

1,153.20

669,043.55

669,043.55

-

-

1,000.00

148,582.55

(4,503.79)

-

145,078.75

145,078.75

0.00%

0.00%

33.33%

60.19%

-295.63%

0.00%

21.68%

21.68%

Equity Attributable to Owners Of The

Parent Entity

Common Share Capital parvalue

Rp100 per Share in 2017 and Rp500

per Share in 2016

Authorized - 10,000,000,000 shares

in 2017 and 2,000,000,000 shares

in 2016

Issued and fully paid 4,155,602,595

shares in 2017 and 831,120,519

shares in 2016

Capital Paid-in Excess of Par Value

Retained Earnings

Appropriated

Unappropriated

Other Comprehensive Income

Other Reserves

Total Equity Attributable to:

Owners of the Parent Entity

TOTAL EQUITY

Liabilitas Jangka Pendek

Perseroan membukukan liabilitas jangka pendek sebesar

Rp1.260.868,22 juta pada tahun 2017, mengalami kenaikan

sebesar Rp292.545,46 juta atau 30,21% dibandingkan

Rp968.322,76 juta pada tahun 2016. Kenaikan liabilitas

jangka pendek terutama diakibatkan oleh utang sewa

guna usaha dan utang pembiayaan konsumen walaupun

utang lain-lain dan utang derivatif mencatat penurunan

cukup signifikan.

Liabilitas Jangka Panjang

Perseroan membukukan liabilitas jangka panjang sebesar

Rp35.175,97 juta pada tahun 2017, mengalami kenaikan

sebesar Rp4.332,19 juta atau 14,05% dibandingkan

Rp30.843,79 juta pada tahun 2016. Kenaikan liabilitas

jangka panjang terutama diakibatkan oleh peningkatan

utang pembiayaan konsumen secara signifikan sebesar

89,32% walaupun utang bank mengalami penurunan

signifikan sebanyak 100%.

Ekuitas

Per 31 Desember 2017, Perseroan membukukan ekuitas

sebesar Rp814.122,31 juta, mengalami kenaikan sebesar

Rp145.078,75 jutaatau21,68%dibandingkanRp669.043,55

juta pada tahun 2016. Kenaikan ekuitas pada tahun 2017

terutama dikontribusikan oleh peningkatan saldo laba,

baik saldo laba dicadangkan maupun tidak dicadangkan.

Peningkatan saldo laba berhasil mengkompensasikan

turunnya penghasilan komprehensif yang dibukukan

selama tahun 2017.

Perbandingan realisasi ekuitas untuk tahun buku yang

berakhir pada 31 Desember 2017 dan 31 Desember 2016

dijabarkan dalam tabel berikut:

Current Liabilities

The Company booked current liabilities amounted

Rp1,260,868.22 million in 2017, grew by Rp292,545.46

million or 30.21% compared to Rp968,322.76 million in

2016. The increasing of current liabilities was mainly

driven by increasing finance leases payables and

consumer financing payables despite other payables and

derivative payables recorded a significant decrease.

Non-Current Liabilities

The Company booked non-current liabilities amounted

Rp35,175.97 million in 2017, increased by Rp4,332.19

million or 14.05% compared to Rp30,843.79 million in

2016. The increasing in non-current liabilities was mainly

contributed from increasing consumer financing payables

significantly by 89.32% despite bankloans decreased

significantly by 100%.

Equity

As of December 31, 2017, the Company booked total equity

of Rp814,122.31 million, increased by Rp145,078.75 million

or 21.68% compared to Rp669,043.55 million in 2016.

The increasing equity in 2017 was mainly contributed

from increasing retained earnings, both appropriate

and unappropriate retained earnings. The increasing

retained earnings successfully compensated decreasing

comprehensive incomes booked throughout 2017.

Comparative equity realization for fiscal year ended on

December 31, 2017 and December 31, 2016 is presented in

table below:

EKUITAS (dalam jutaan Rupiah, kecuali dinyatakan lain)

Equity (in million Rupiah, unless stated otherwise)

Selisih /

Difference