The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2018 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2018 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

44

3. MANAJEMEN

RISIKO

KEUANGAN

DAN

MANAJEMEN PERMODALAN (lanjutan)

3. FINANCIAL RISK MANAGEMENT AND CAPITAL

MANAGEMENT (continued)

a. Manajemen Risiko Keuangan (lanjutan)

a. Financial Risk Management (continued)

(ii) Risiko kredit (lanjutan)

(ii) Credit risk (continued)

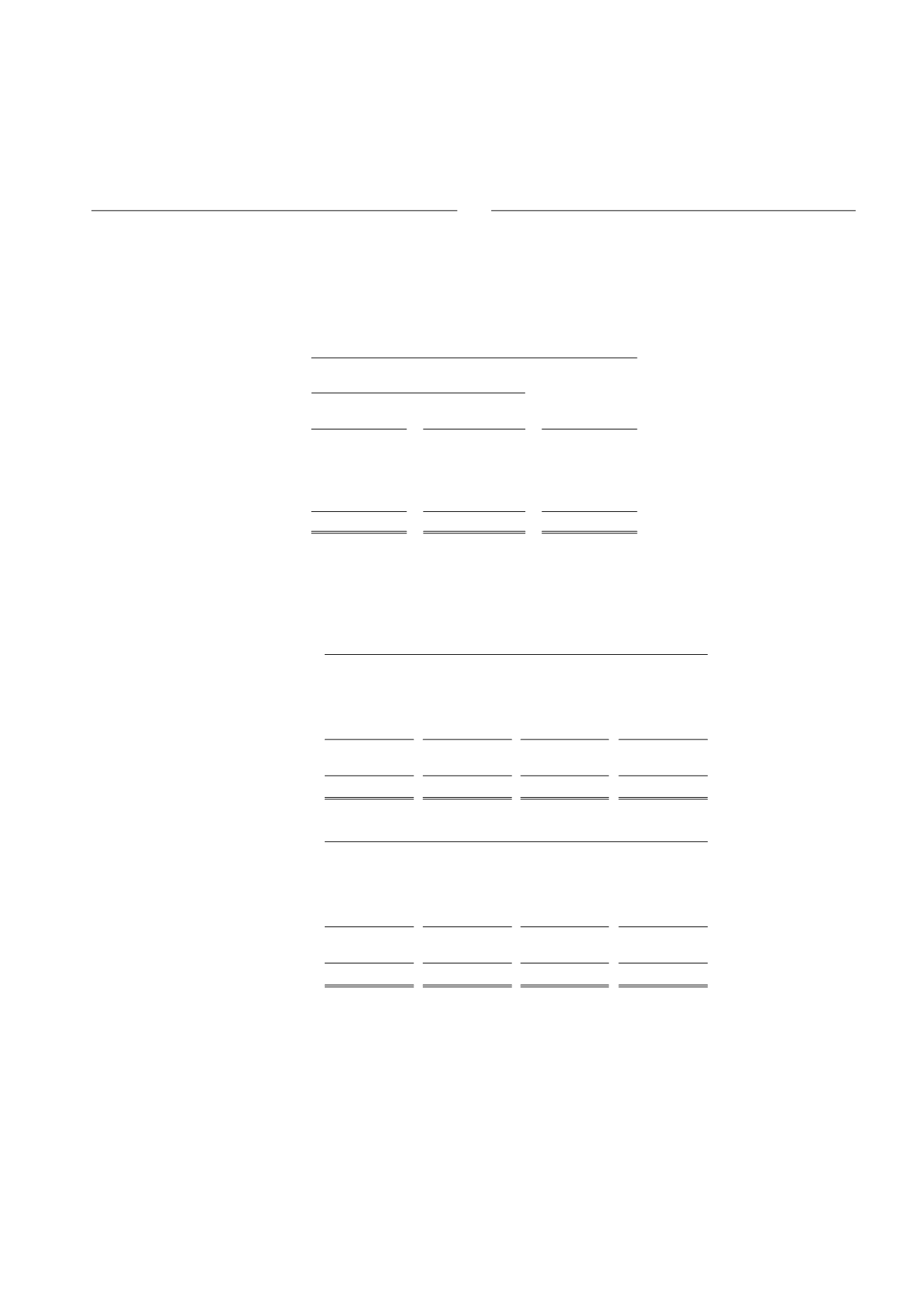

2017

Konsentrasi Risiko Kredit/

Concentration of Credit Risk

Eksposur

Maksimum/

Institusi/

Lainnya/

Maximum

Institution

Others

Exposure

Kas dan setara kas

154.381.240.915

- 154.381.240.915

Cash and cash equivalents

Dana yang terbatas

penggunaannya

13.530.796.681

-

13.530.796.681

Restricted funds

Piutang usaha, bersih 714.558.597.427

- 714.558.597.427

Trade receivables, net

Piutang lain-lain

58.088.905.052

-

58.088.905.052

Other receivables

Piutang derivatif

11.794.822.909

-

11.794.822.909

Derivative receivables

952.354.362.984

- 952.354.362.984

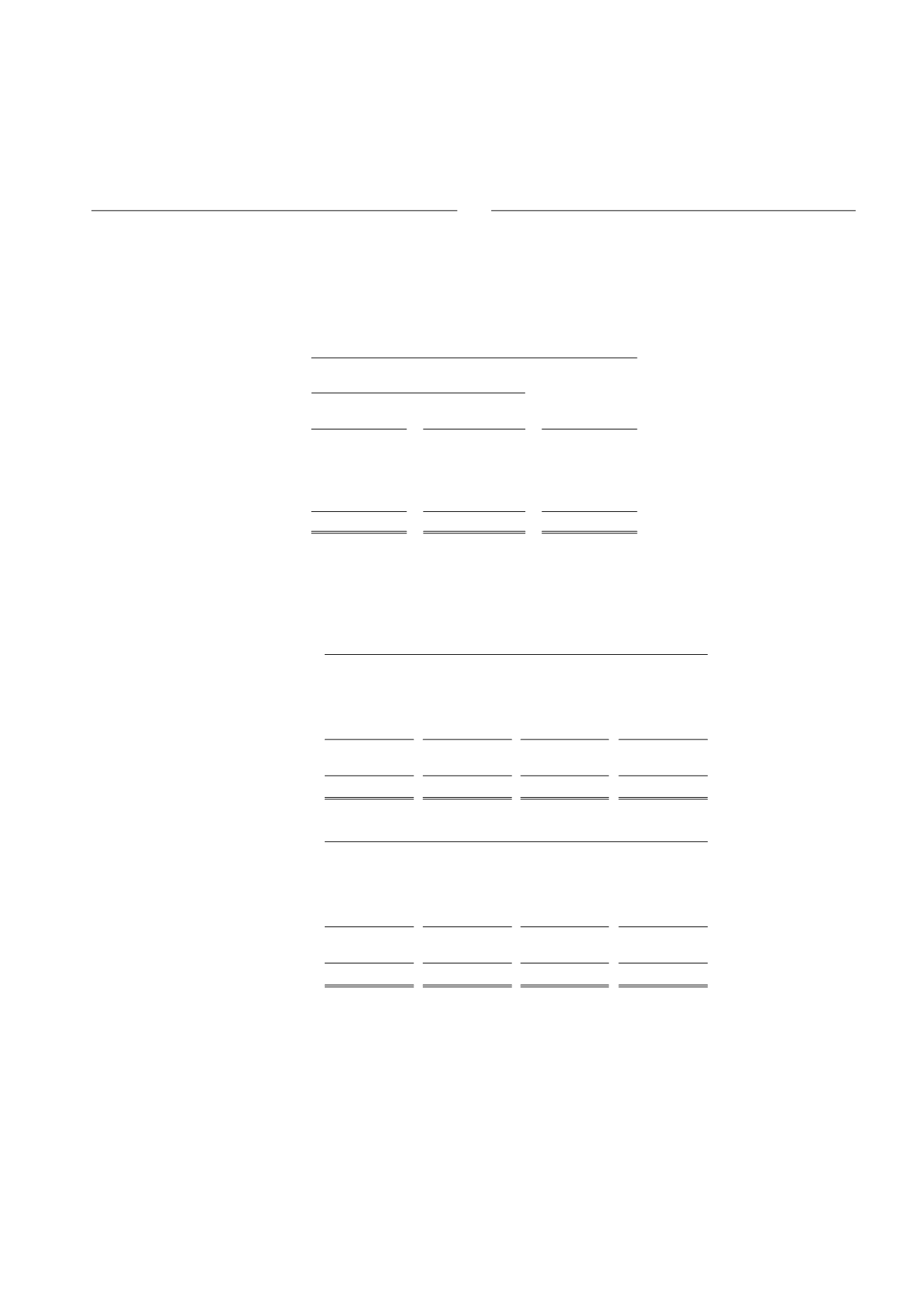

Pada tanggal 31 Desember 2018 dan

2017, saldo terutang dari piutang usaha

dan piutang lain-lain adalah sebagai

berikut:

As of December 31, 2018 and 2017, the

balances

outstanding

from

trade

receivables and other receivables were as

follows:

2018

Belum jatuh

Telah jatuh Telah jatuh

tempo dan tempo tetapi

tempo dan

tidak mengalami tidak mengalami mengalami

penurunan nilai/ penurunan nilai/ penurunan nilai/

Neither past due

Past due Past due and

Jumlah/

nor impaired but not impaired

impaired

Total/

Piutang usaha

401.523.600.810 394.403.160.930 22.445.441.548 818.372.203.288

Trade receivables

Piutang lain-lain

75.030.142.666

431.181.376

- 75.461.324.042

Other receivables

Jumlah

476.553.743.476 394.834.342.306 22.445.441.548 893.833.527.330

Total

2017

Belum jatuh

Telah jatuh Telah jatuh

tempo dan tempo tetapi

tempo dan

tidak mengalami tidak mengalami mengalami

penurunan nilai/ penurunan nilai/ penurunan nilai/

Neither past due

Past due Past due and

Jumlah/

nor impaired but not impaired

impaired

Total/

Piutang usaha

385.287.951.674 329.270.645.753 16.543.982.813 731.102.580.240

Trade receivables

Piutang lain-lain

57.657.723.676

431.181.376

- 58.088.905.052

Other receivables

Jumlah

442.945.675.350 329.701.827.129 16.543.982.813 789.191.485.292

Total

Pada tanggal 31 Desember 2018 dan

2017, Grup telah mencadangkan secara

penuh nilai piutang usaha yang telah jatuh

tempo dan mengalami penurunan nilai.

As of December 31, 2018 and 2017, the

Group had fully provided the allowance for

the balance of trade receivables which

have been past due and impaired.

Seluruh saldo terutang dari piutang usaha

dan piutang lain-lain di atas terutama

berasal dari pelanggan/pihak ketiga/pihak

berelasi yang sudah ada lebih dari

12 bulan dan tidak memiliki sejarah

wanprestasi.

The entire outstanding balance from trade

receivables and other receivables are

mostly derived from customers/third

parties/related parties which have existed

for more than 12 months and do not have

any default history.