The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2018 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2018 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

55

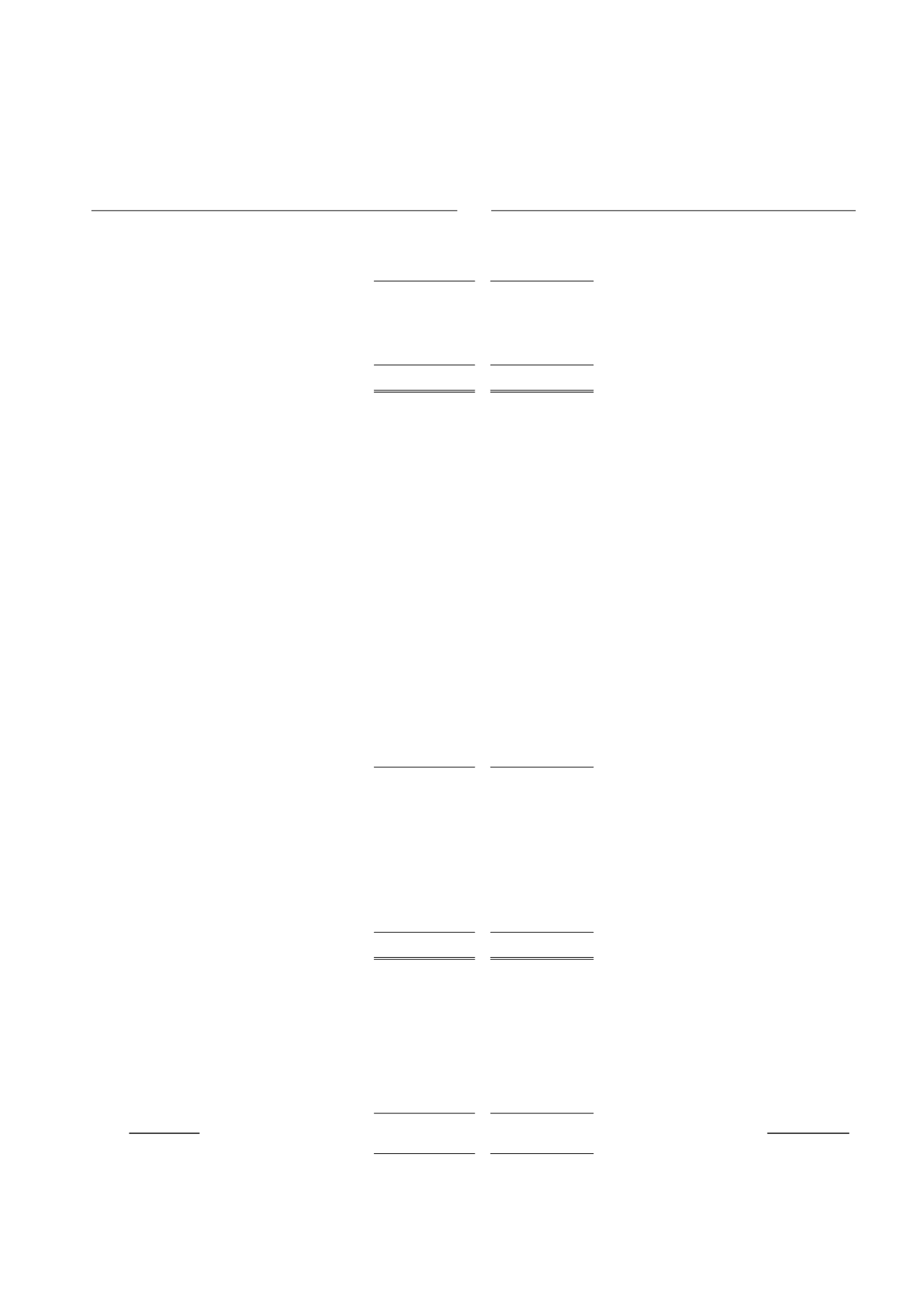

10. PERSEDIAAN

10. INVENTORIES

2018

2017

Barang jadi

371.616.507.911 342.133.284.805

Finished goods

Barang dalam proses

59.422.981.052 77.663.654.969

Work in process

Bahan baku

105.855.882.739 212.736.586.290

Raw materials

Bahan pembantu

21.122.910.549 17.267.220.337

Supplies

Suku cadang

3.230.697.894

3.215.938.558

Spare parts

Total

561.248.980.145 653.016.684.959

Total

Pada tanggal 31 Desember 2018, persediaan Grup

telah diasuransikan terhadap risiko kebakaran dan

risiko lainnya dengan nilai pertanggungan sebesar

Rp636,03

milyar

(2017: Rp432,6

milyar).

Manajemen

berpendapat

bahwa

nilai

pertanggungan tersebut cukup memadai untuk

menutup kemungkinan kerugian yang timbul atas

risiko-risiko yang dipertanggungkan tersebut.

As of December 31, 2018, the Group’s inventories

were covered by insurance against the risk of fire

and other risks with total coverage of Rp636.03

billions (2017: Rp432.6 billions). Management

believes that the amounts of insurance coverage

are adequate to cover any possible losses that

may arise.

Pada tanggal 31 Desember 2018 dan 2017,

seluruh persediaan dijadikan sebagai jaminan atas

pinjaman bank jangka pendek PT Bank Mandiri

(Persero) Tbk (Catatan 17).

As of December 31, 2018 and 2017, all inventories

are used as collateral for short-term bank loans

with PT Bank Mandiri (Persero) Tbk (Note 17).

Manajemen berpendapat bahwa nilai tercatat

persediaan pada tanggal 31 Desember 2018 dan

2017 telah mencerminkan nilai realisasi bersihnya.

Management believes that the carrying value of the

inventories as of December 31, 2018 and 2017 has

reflected the net realizable value.

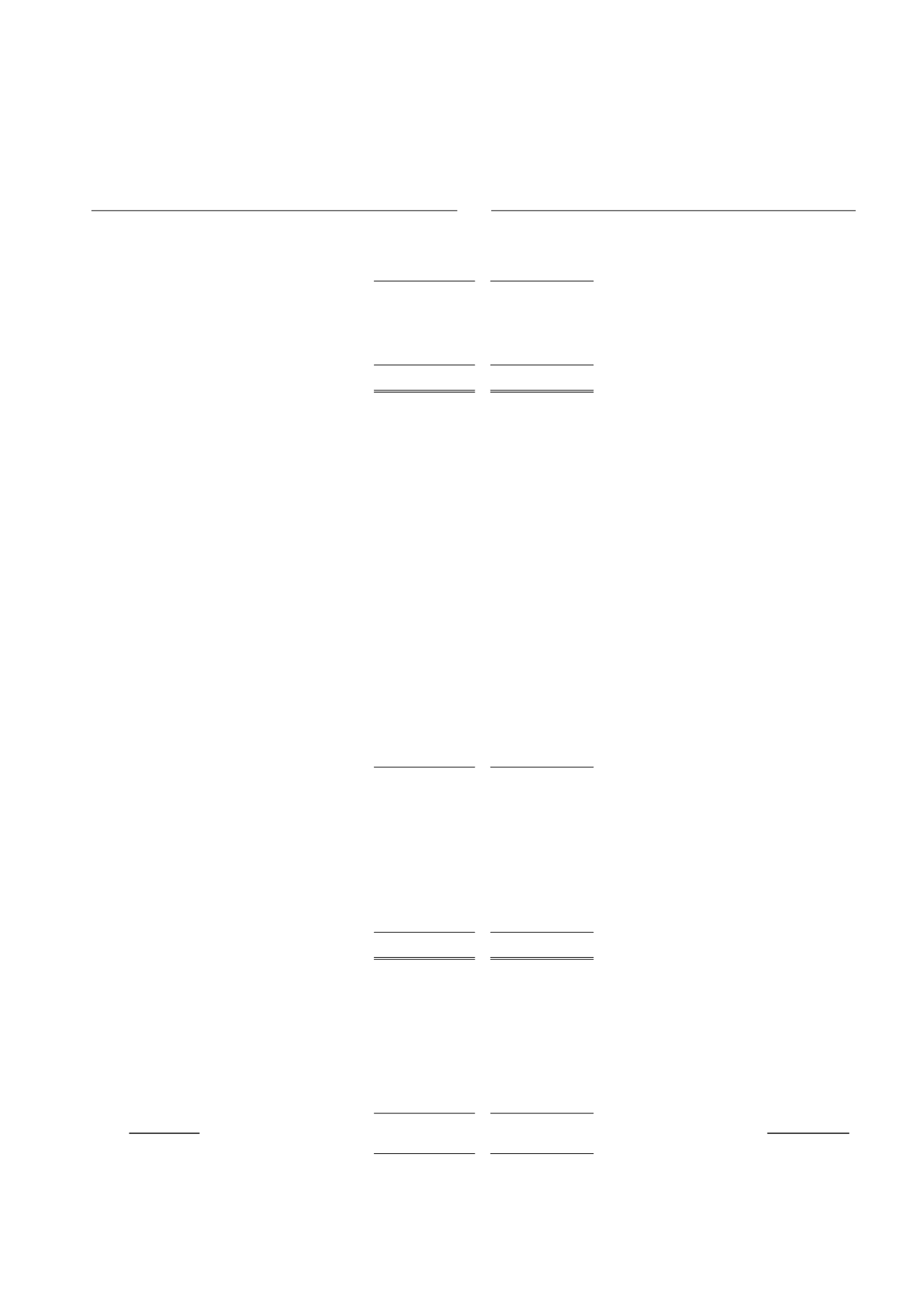

11. ASET LANCAR LAINNYA

11. OTHER CURRENT ASSETS

2018

2017

Pihak ketiga:

Third parties:

Uang muka pembelian lokal

71.905.104.003 12.573.498.598

Advances purchase for local

Uang muka pembelian aset

13.315.900.000 13.240.758.000

Advances purchase for assets

Uang muka pembelian impor

9.455.719.371

7.619.572.401

Advances purchase for import

Sewa dibayar dimuka

1.324.205.410

1.184.662.355

Prepaid rent

Provisi bank

1.032.179.641

809.303.883

Bank provision

Asuransi dibayar dimuka

730.841.084

628.255.869

Prepaid insurance

Lain-lain

1.629.891.038

1.312.967.129

Others

Pihak berelasi:

Related party:

Jiangsu Hengtong S.P.C Co.,Ltd.

3.954.447.000

-

Jiangsu Hengtong S.P.C Co.,Ltd.

Total

103.348.287.547 37.369.018.235

Total

12. PROYEK DALAM PELAKSANAAN

12. PROJECTS IN PROGRESS

Merupakan proyek dalam pelaksanaan jangka

panjang atas jasa kontraktor dengan rincian

sebagai berikut:

This is consists of long-term project in progress for

contractors service with details as follows:

2018

2017

Perusahaan

The Company

Pembangunan jaringan kabel ICON+

8.194.101.594

-

Pembangunan jaringan kabel ICON+