The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2018 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2018 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

60

16. INSTRUMEN KEUANGAN DERIVATIF

16. DERIVATIVE FINANCIAL INSTRUMENT S

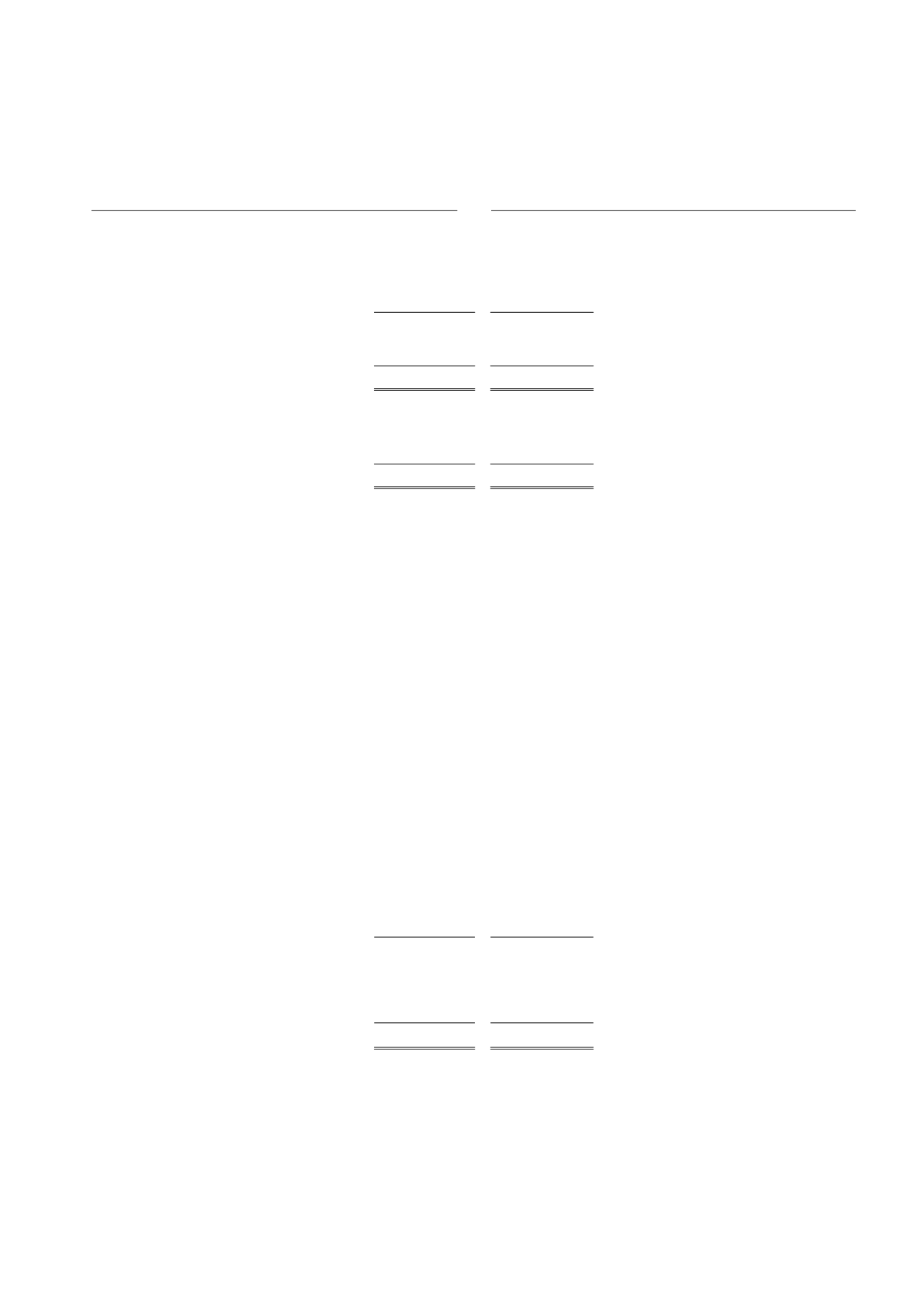

a. Piutang derivative

a. Derivative receivables

2018

2017

KGI Ong Capital Pte., Ltd.

KGI Ong Capital Pte., Ltd.

(d.h Ong First Pte., Ltd.)

9.670.575.580 11.699.282.909

(formerly Ong First Pte.,Ltd.)

PT Straits Futures Indonesia

820.853.125

95.540.000

PT Straits Futures Indonesia

Total

10.491.428.705 11.794.822.909

Total

b. Utang derivative

b. Derivative payable

2018

2017

PT Bank Mandiri (Persero) Tbk.

15.071.429

10.669.582

PT Bank Mandiri (Persero) Tbk.

Transaksi

Swap dan Forward

Komoditas

Swap and Forward Commodity Transaction

Perusahaan menghadapi risiko harga akibat

perubahan harga dimasa yang akan datang

untuk rencana pembelian Aluminium dan

Tembaga dengan Kandungan Tinggi (

High

Concentrate Aluminum and Copper

). Oleh

karena itu, Perusahaan menggunakan kontrak

komoditas berjangka (jual-beli) sehubungan

dengan adanya risiko perubahan harga bahan

baku tersebut.

The Company faces the price risk associated

with price changes in the future to plan the

purchase of Aluminum and Copper with high

content (High Concentrate Aluminum and

Copper). Therefore, the Company uses

commodity futures contracts (sell-buy)

associated with the risk of changes in raw

material prices.

Menurut kontrak tersebut, Perusahaan harus

menempatkan sejumlah uang sebagai nilai

awal kontrak, untuk kemudian dikelola oleh

Perusahaan Broker.

Under such contracts, the Company must put

a certain amount at the inception of the

contract, then to be managed by a Brokerage

Firm.

Keuntungan atau kerugian dari setiap transaksi

penyelesaian derivatif akan secara otomatis

dibukukan dan akan menambah atau

mengurangi jumlah nilai awal kontrak yang

ada. Nilai kontrak Perusahaan dihitung

berdasarkan harga

forward

maupun

swap

di

London Metal Exchange.

Gains or losses of any settlement of the

derivative transaction will be automatically

recorded and will be added to or subtracted

from the existing value. The contract value is

calculated based on a forward price swap at

the London Metal Exchange.

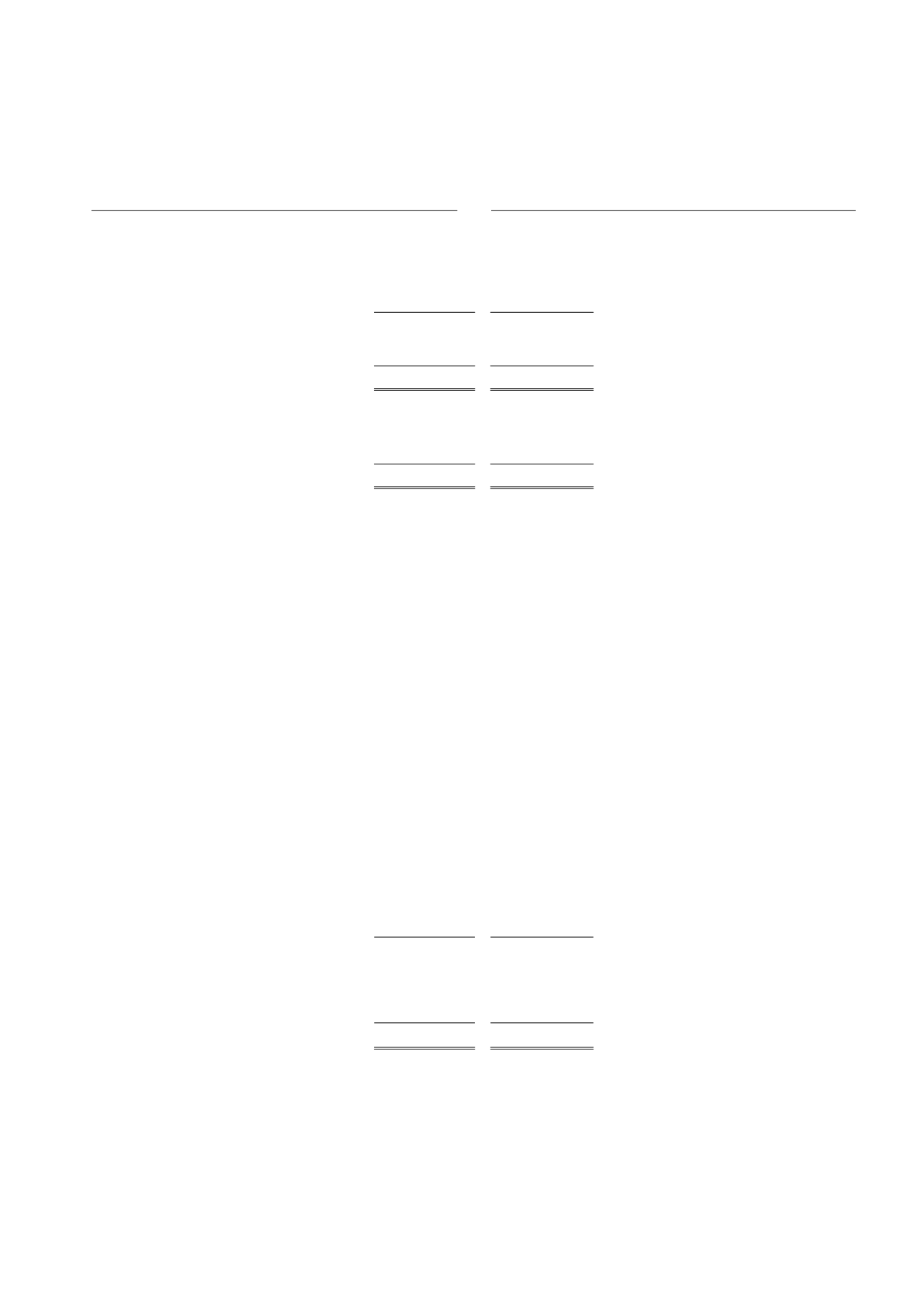

2018

2017

KGI Ong Capital Pte., Ltd.

KGI Ong Capital Pte., Ltd.

(31 Desember 2018:

(December 31, 2018:

USD283.386,99;

USD283,386.99;

31 Desember 2017:

December 31, 2017:

USD477.764,38)

4.103.727.002

6.472.751.820

USD477,764.38)

Total aset

4.103.727.002

6.472.751.820

Total assets