The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2014 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2014 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

60

18. UTANG LAIN-LAIN

18. OTHER PAYABLES

Pada tanggal 31 Desember 2014, akun ini terdiri

atas utang pinjaman atas barang jadi, bahan baku,

dan konsorsium oleh Perusahaan dan PME

kepada pihak ketiga sebesar Rp51.506.054.901,

utang lain-lain atas talangan dana dari pihak ketiga

kepada Perusahaan sebesar Rp7.825.137.952 dan

utang

pemegang

saham

CGS

sebesar

Rp5.000.000,

sedangkan

pada

tanggal

31 Desember 2013, utang lain-lain terdiri atas

utang pinjaman atas barang jadi, bahan baku, dan

konsorsium oleh Perusahaan kepada pihak ketiga

sebesar Rp56.238.987.073, jaminan pelanggan

PME

kepada

pihak

ketiga

sebesar

Rp9.506.440.285, dan utang pemegang saham

CGS sebesar Rp5.000.000.

As of December 31, 2014, this account consists of

payables of finished goods, raw material and

consortium by the Company and PME to third

party amounting to Rp51,506,054,901, bail-out

fund from third party to the Company amounting to

Rp7,825,137,952 and CGS shareholder payable

amounting to Rp5,000,000, meanwhile as of

December 31, 2013, other payables consist of

payables of finished goods, raw material and

consortium by the Company to third party

amounting to Rp56,238,987,073, PME’s customer

guarantee to third party amounting to

Rp9,506,440,285 and CGS shareholder payable

amounting to Rp5,000,000.

19. PERPAJAKAN

19. TAXATION

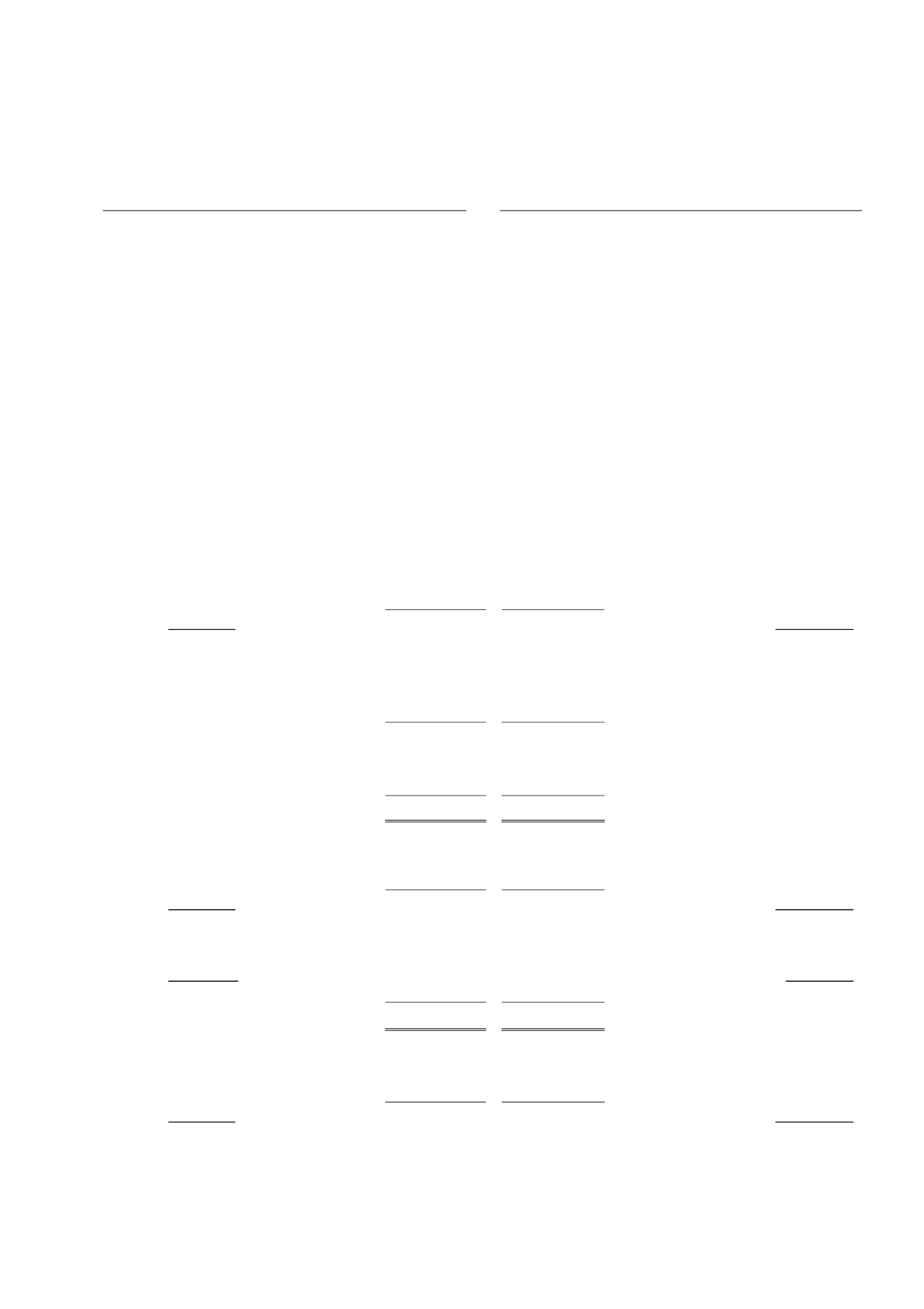

a. Estimasi Tagihan Pajak

a. Estimated Claims for Tax Refund

2014

2013

Perusahaan

The Company

Pajak Penghasilan Badan 2014 32.637.704.399

-

Corporate Income Tax 2014

Pajak Penghasilan Badan 2013 28.450.362.478 28.406.284.795

Corporate Income Tax 2013

Pajak Pertambahan Nilai

Valued-added taxes on

Agustus 2014

1.122.514.133

-

August 2014

Pajak Pertambahan Nilai 2013

17.614.417.466 76.286.666.664

Value-added taxes 2013

Pajak Pertambahan Nilai 2012

- 15.020.423.931

Value-added taxes 2012

79.824.998.476 119.713.375.390

Dikurangi estimasi tagihan pajak

yang jatuh tempo dalam

Less current maturities of

waktu satu tahun

46.064.779.944

-

estimated claims for tax refund

Bagian jangka panjang

33.760.218.532

119.713.375.390

Long-term portion

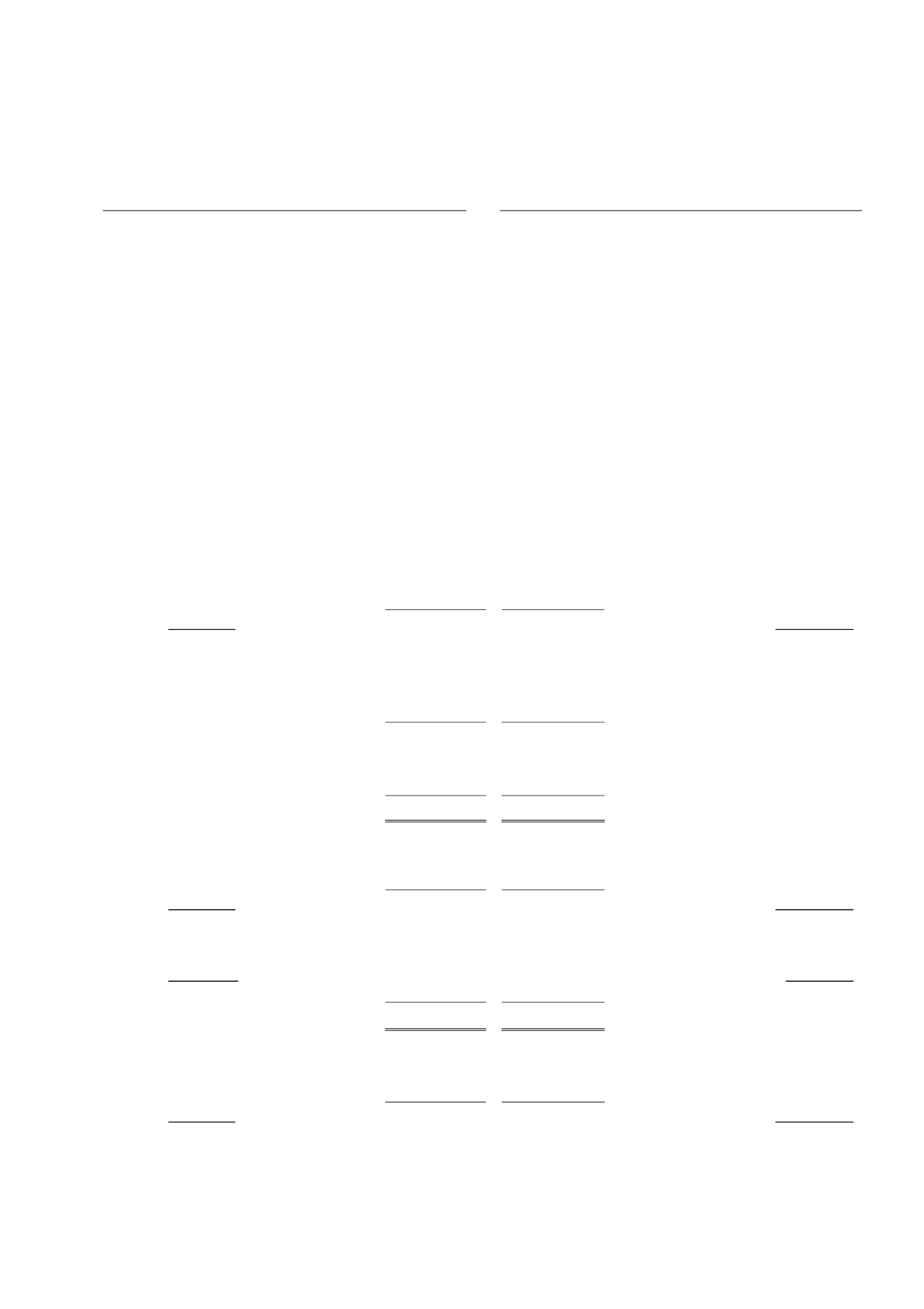

b. Pajak Dibayar di Muka

b. Prepaid Taxes

2014

2013

Perusahaan

The Company

Pajak Pertambahan Nilai

Value-added taxes on

September - Desember 2014 14.356.022.370

-

September - December 2014

Pajak Penghasilan Pasal 22

219.387.414

-

Income Tax Article 22

Entitas Anak

Subsidiaries

Pajak Pertambahan Nilai

2.803.634.670

54.874.740

Value-added taxes

Total

17.379.044.454

54.874.740

Total

c. Utang Pajak

c. Taxes Payable

2014

2013

Perusahaan

The Company

Pajak Penghasilan Pasal 21

231.431.908

161.024.450

Income Tax Article 21

Pajak Penghasilan Pasal 23

18.852.289

39.404.525

Income Tax Article 23

Pajak Penghasilan Pasal 25

-

366.574.927

Income Tax Article 25

Pajak Penghasilan Pasal 26

-

171.893.128

Income Tax Article 26

Pajak Penghasilan Pasal 4 ayat 2

-

3.382.399

Income Tax Article 4(2)

Pajak Penghasilan Pasal 29

-

-

Income Tax Article 29