The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2014 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2014 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

61

19. PERPAJAKAN (lanjutan)

19. TAXATION (continued)

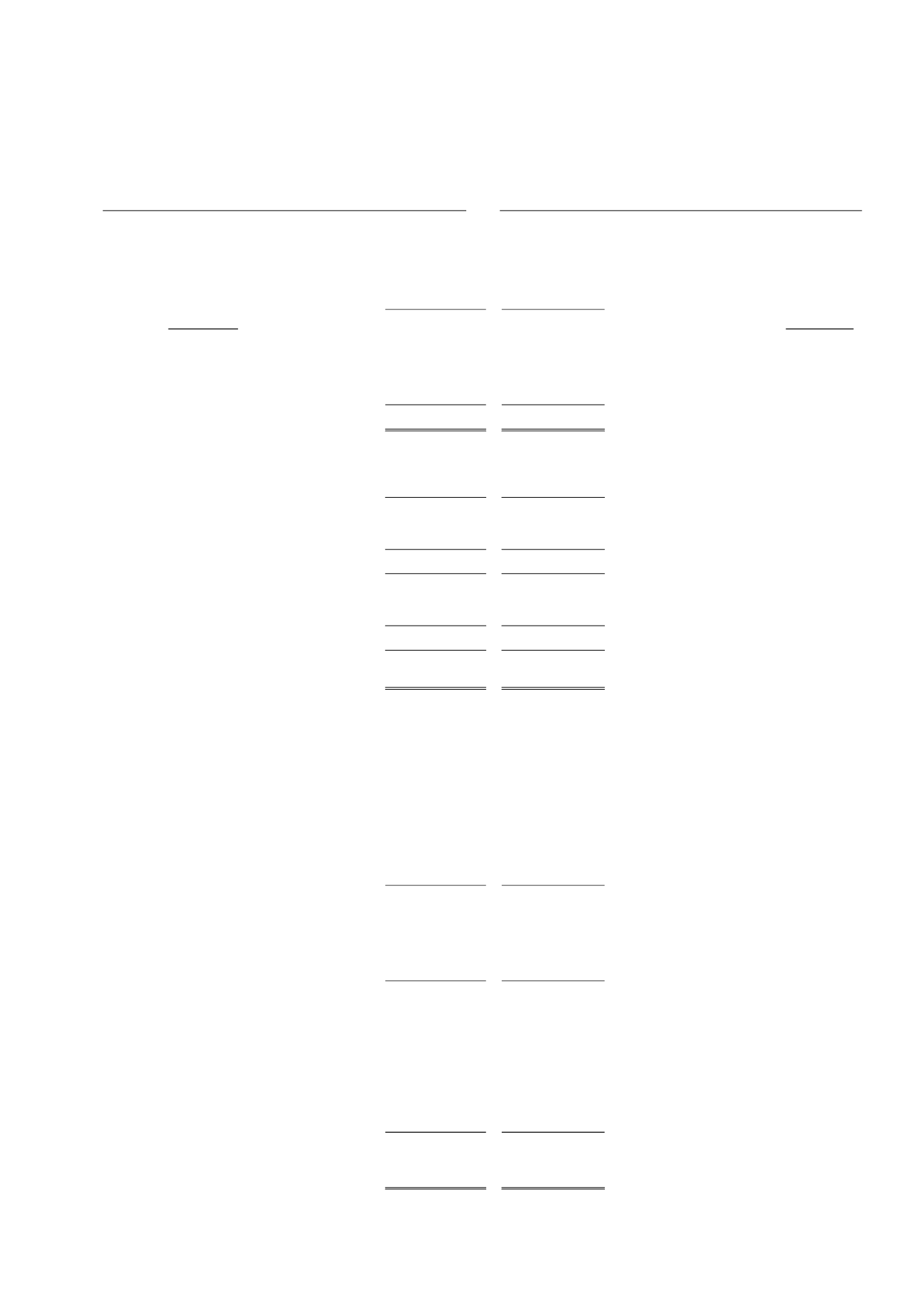

c. Utang Pajak (lanjutan)

c. Taxes Payable (continued)

2014

2013

Entitas Anak

Subsidiaries

Pajak Penghasilan Pasal 21

173.542.074

241.911.432

Income Tax Article 21

Pajak Penghasilan Pasal 23

21.869.690

6.403.310

Income Tax Article 23

Pajak Penghasilan Pasal 25

62.978.938

93.995.702

Income Tax Article 25

Pajak Penghasilan Pasal 29

6.763.592

273.556.633

Income Tax Article 29

Pajak Pertambahan Nilai

2.365.274.506

430.785.173

Value Added Tax

Total

2.880.712.997

1.788.931.679

Total

d. Beban Pajak

d. Tax Expense

2014

2013

Pajak kini:

Current tax:

Perusahaan

-

5.697.021.400

The Company

Entitas Anak

1.928.527.046

3.763.574.053

Subsidiaries

1.928.527.046

9.460.595.453

Pajak tangguhan:

Deferred tax:

Perusahaan

(29.746.830.548)

2.865.059.280

The Company

Entitas Anak

293.319.436

183.809.537

Subsidiaries

(29.453.511.112)

3.048.868.817

(Manfaat) beban pajak

Consolidation tax

Konsolidasian

(27.524.984.066) 12.509.464.270

(benefit) expenses

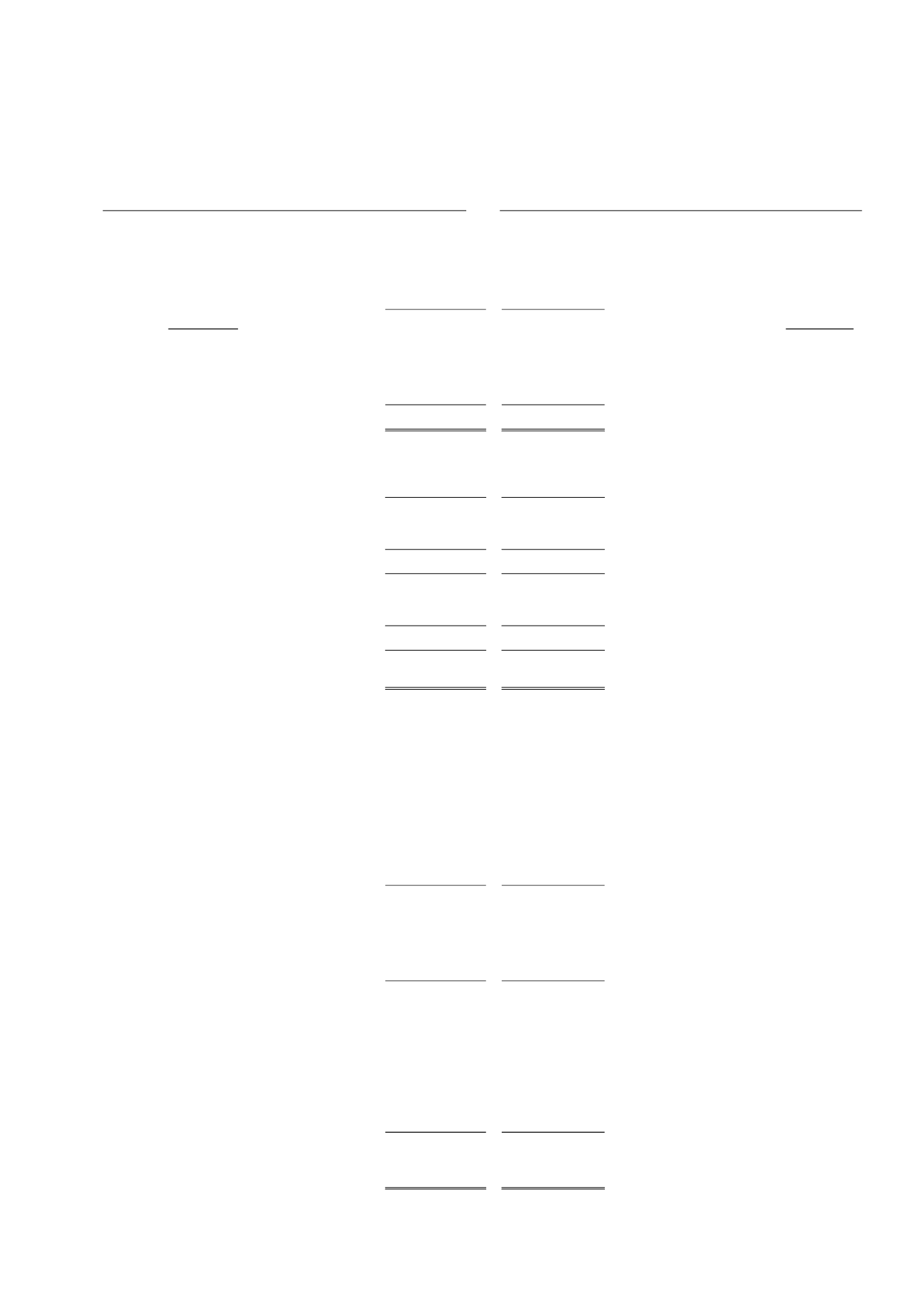

Rekonsiliasi

antara

estimasi

pajak

penghasilan

yang

dihitung

dengan

menggunakan tarif pajak yang berlaku

sebesar 25% dari laba akuntansi sebelum

estimasi beban (manfaat) pajak penghasilan

seperti yang tercantum dalam laporan laba

rugi komprehensif konsolidasian untuk tahun

yang berakhir pada tanggal 31 Desember

2014 dan 2013 adalah sebagai berikut:

The reconciliation between tax expense

computed using the prevailing tax rate of 25%

on the accounting income before estimated

tax expense (benefit) reported in the

consolidated statements of comprehensive

income for the years ended as of December

31, 2014 and 2013 is as follows:

2014

2013

Laba (rugi) sebelum pajak penghasilan

Profit (loss) before income tax

menurut laporan laba rugi

per consolidated statement

komprehensif konsolidasian

(112.918.817.652) 51.602.217.442

of comprehensive income

Penghasilan bersih dari

pendapatan final

(2.100.151.110) (1.768.566.679)

Income subjected to final tax

Penyesuaian konsolidasian

-

58.127.590

Consolidation adjustments

Laba sebelum manfaat (beban) pajak

Consolidated profit before tax benefit

konsolidasian sebelum eliminasi (115.018.968.762) 49.891.778.353

(expense) before elimination

Beban pajak tarif 25%

(28.754.742.191) 12.472.944.588

Tax expense computed using rate 25%

Pengaruh pajak atas beda tetap

Tax effects of the Company

Perusahaan dan

and Subsidiaries permanent

Entitas Anak

1.192.508.500

1.383.758.222

differences

Pengaruh penurunan tarif pajak

Effect of income tax rate reduction

penghasilan dalam perhitungan

used in current tax computation

pajak kini Perusahaan

37.249.625 (1.347.238.540)

in the Company

Taksiran (manfaat) beban pajak neto

Estimated tax (benefit) expense-net per

menurut laporan laba rugi

consolidated statement

komprehensif konsolidasian

(27.524.984.066) 12.509.464.270

of comprehensive income