The original consolidated financial statements included herein are in

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

31 Desember 2019 dan 2018 dan untuk tahun-tahun

yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

December 31, 2019 and 2018

and for the years then ended

(Expressed in Rupiah, unless otherwise stated)

63

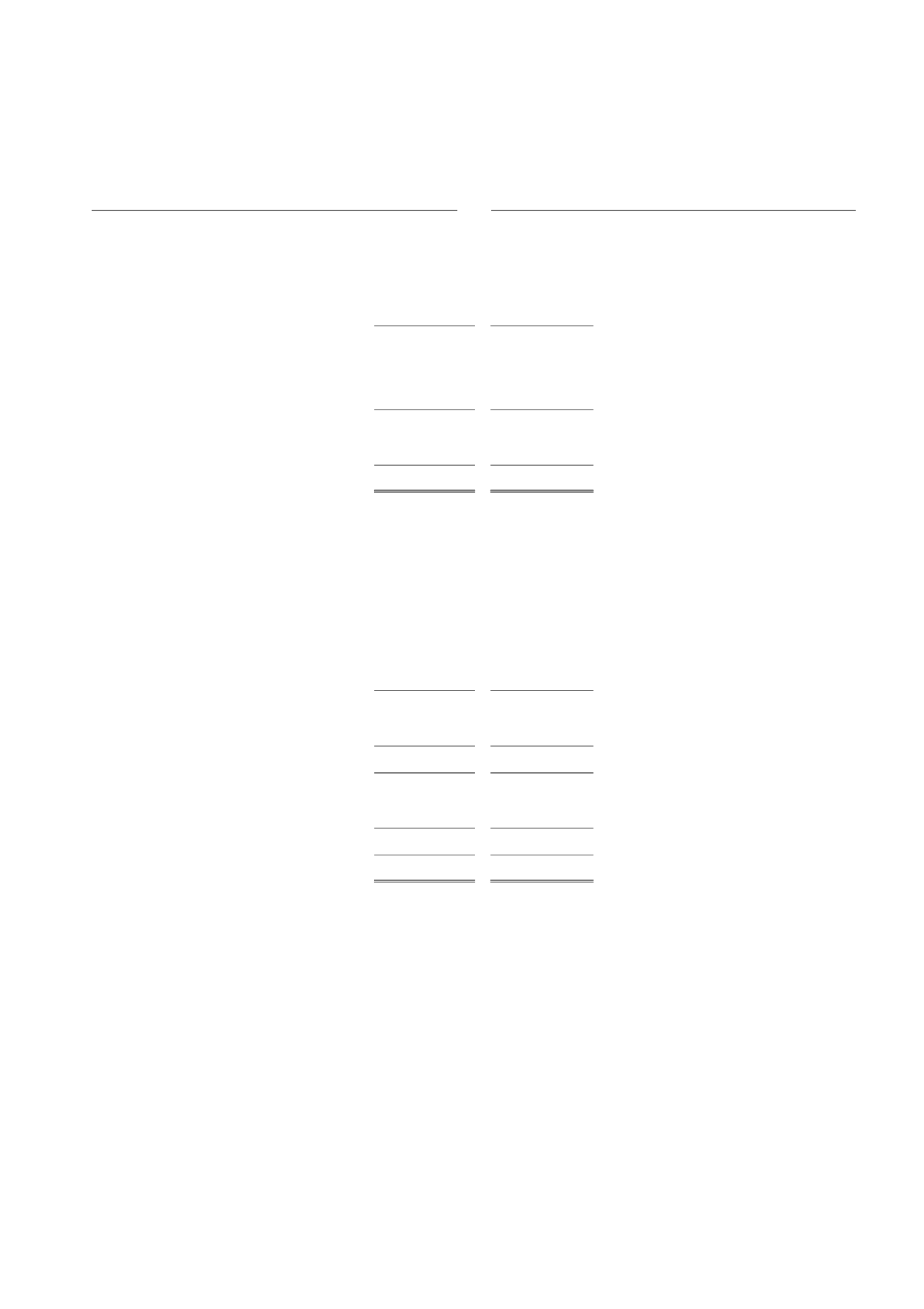

9. PIUTANG USAHA (lanjutan)

9. TRADE RECEIVABLES (continued)

Rincian piutang usaha menurut jenis mata uang

adalah sebagai berikut:

The details of trade receivables based on

currencies are as follows:

2019

2018

Rupiah

922.211.288.032 790.753.088.541

Rupiah

Mata Uang Asing

Foreign Currency

(31 Desember 2019:USD1.404.315,43;

(December 31, 2019: USD1,404,315.43;

dan 31 Desember 2018:

and December 31, 2018:

USD1.907.265,71)

19.777.182.518 27.619.114.747

USD1,907,265.71)

941.988.470.550 818.372.203.288

Dikurangi:

Less:

Cadangan kerugian penurunan nilai (42.415.295.676) (22.445.441.548)

Allowance for impairment loss

Total

899.573.174.874 795.926.761.740

Total

Pada tanggal 31 Desember 2019 dan 2018,

sejumlah piutang usaha senilai minimal 100% dari

limit kredit yang diterima dari PT Bank Mandiri

(Persero) Tbk dan PT Bank Nusantara

Parahyangan Tbk dijadikan sebagai jaminan atas

pinjaman bank jangka pendek (Catatan 18).

As of December 31, 2019 and 2018, trade

receivables amounting to minimum of 100% from

credit limit received from PT Bank Mandiri

(Persero) Tbk and PT Bank Nusantara

Parahyangan Tbk have been pledged as a

collateral of short-term bank loans (Note 18).

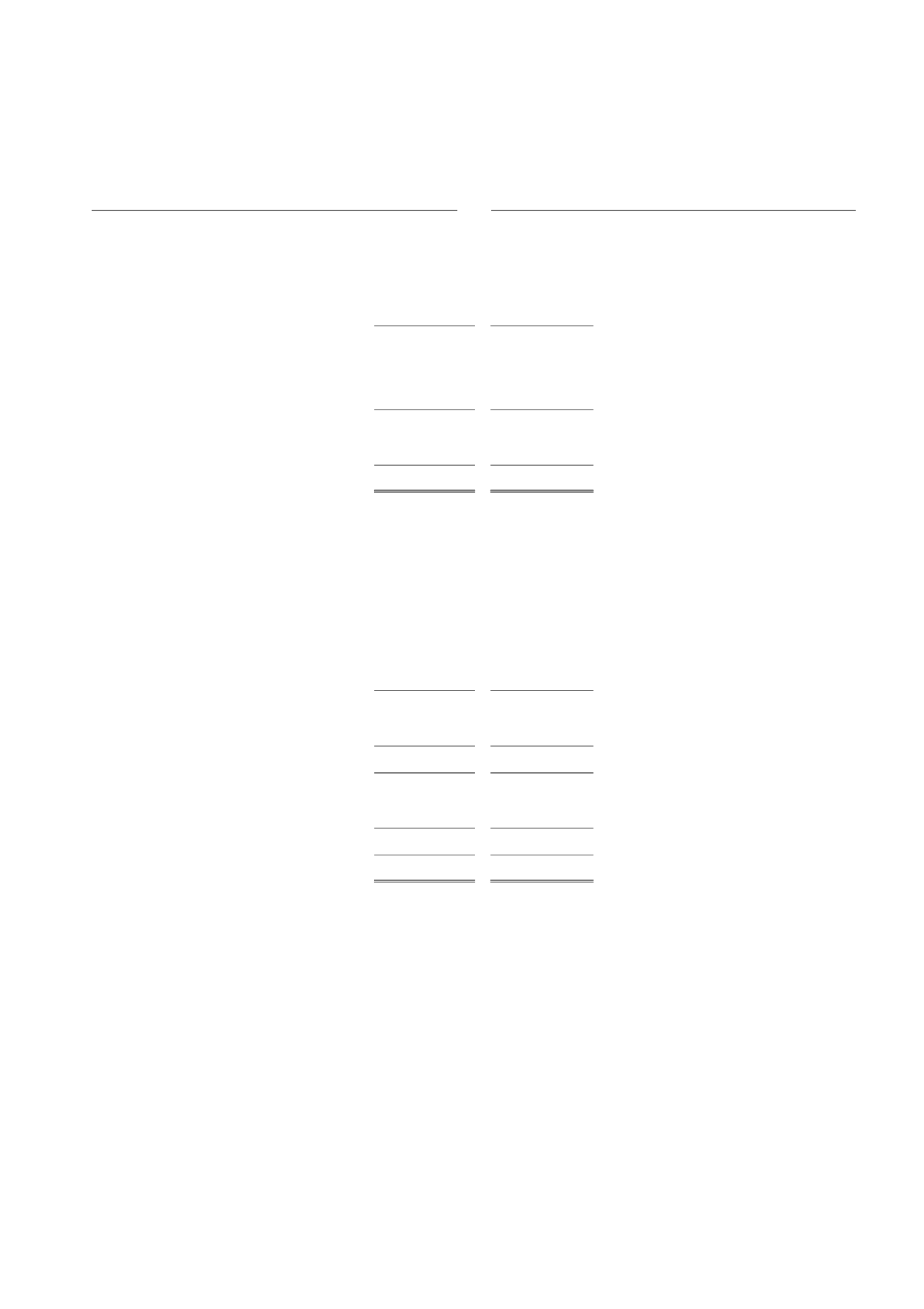

10. PIUTANG LAIN-LAIN

10. OTHER RECEIVABLES

2019

2018*

Pihak ketiga:

Third parties:

Deposit jaminan

58.233.281.944 65.773.226.340

Guarantee deposits

Lain-lain

2.871.164.041

9.495.052.983

Others

61.104.445.985 75.268.279.323

Pihak berelasi:

Related parties:

PT Maju Bersama Gemilang

236.171.604

99.051.117

PT Maju Bersama Gemilang

SWCC Showa Holdings Co., Ltd.

-

93.993.602

SWCC Showa Holdings Co., Ltd.

236.171.604

193.044.719

Total

61.340.617.589 75.461.324.042

Total

*) Setelah reklasifikasi - Catatan 45

*)

After reclassification - Note 45

Deposito jaminan diatas merupakan

marginal

deposit

sehubungan dengan fasilitas

Letter of

Credit

(L/C) dan garansi bank yang diberikan

PT Bank Mandiri (Persero) Tbk kepada

Perusahaan (Catatan 18).

Guarantee deposits are marginal deposit in relation

with Letter of Credit (L/C) and Bank Guarantee

facilities given by PT Bank Mandiri (Persero) Tbk to

the Company (Note 18).

Berdasarkan hasil penelaahan kolektibilitas akun

piutang lain-lain masing-masing pelanggan pada

akhir tahun, Manajemen berpendapat tidak perlu

membentuk penyisihan kerugian penurunan nilai

karena berkeyakinan seluruh piutang lain-lain

dapat tertagih.

Based on the review of collectibility of the individual

other receivables account at the end of the years,

Management believes that it is not necessary to

provide allowance for impairment loss since all

other receivables are collectible.

Manajemen berpendapat bahwa piutang kepada

pihak berelasi dapat ditagih seluruhnya.

Management believes the receivables from related

parties are fully collectible.