Kilas Kinerja

Performance Higlights

Laporan Manajemen

Management Report

Profil Perusahaan

Company Profile

86

PT Voksel Electric Tbk.

Laporan Tahunan 2020

Liabilitas

Liabilitas Perseroan tercatat sebesar Rp1,80 triliun per

akhir tahun 2020. Jumlah liabilitas mengalami penurunan

5,98% jika dibandingkan dengan tahun 2019 yang sebesar

Rp1,92 triliun. Penurunan tersebut disebabkan oleh adanya

beberapa reklasifikasi akun seperti utang sewa guna usaha.

Liabilitas Jangka Pendek

Per akhir tahun 2020, liabilitas jangka pendek Perseroan

tercatat Rp1,18 triliun, turun 8,11% dibandingkan dengan

tahun sebelumnya yang sebesar Rp1,28 triliun. Penurunan

liabilitas jangka pendek disebabkan oleh penurunan nilai

utang sewa guna usaha, utang pembiayaan konsumen, uang

muka pelanggan, provisi bonus, utang pajak, utang lain-

lain, utang usaha pihak ketiga, dan pinjaman bank jangka

pendek.

Liabilitas Jangka Panjang

Liabilitas jangka panjang Perseroan per akhir 2020 sebesar

Rp622,85 miliar. Jumlah ini menurun 1,68% dari liabilitas

jangka panjang tahun 2019 yang sebesar Rp633,51 miliar.

Penurunan dipengaruhi oleh reklasifikasi akun utang sewa

guna usaha.

Ekuitas

Ekuitas yang dimiliki Perseroan per akhir 2020 adalah

Rp1.112 miliar, naik 0,23% dibandingkan Rp1.109 miliar di

tahun 2019. Kenaikan ekuitas sejalan dengan kenaikan saldo

laba.

Liabilities

The Company’s liabilities was recorded at Rp1.80 trillion as

of the end of 2020. Total liabilities has decreased by 5.98%

compared to in 2019 which was Rp1.92 trillion. The decrease

was due to several account reclassification such as finance

lease payable.

Current Liabilities

As of the end of 2020, the Company’s current liabilities

was Rp1.18 trillion, decreased by 8.11% compared to the

previous year which was Rp1.28 trillion. The decrease in

current liabilities was due to the decrease in finance lease

payables, customer financing payable, deposits from

customer, provision of bonus, taxes payable, other payables,

third-party lease payables, and short-term bank loans.

Non-Current Liabilities

The Company’s non-current liabilities as of the end of 2020

was Rp622.85 billion. This amount has decreased by 1.68%

from the non-current liabilities in 2019 which was Rp633.51

billion. The decrease was due to the account reclassification

of finance lease payables.

Equity

The Company's equity as of the end of 2020 was Rp1,112

billion, increased by 0.23% compared to Rp1,109 billion in

2019. The increase in equity was inline with the increase of

retained earnings.

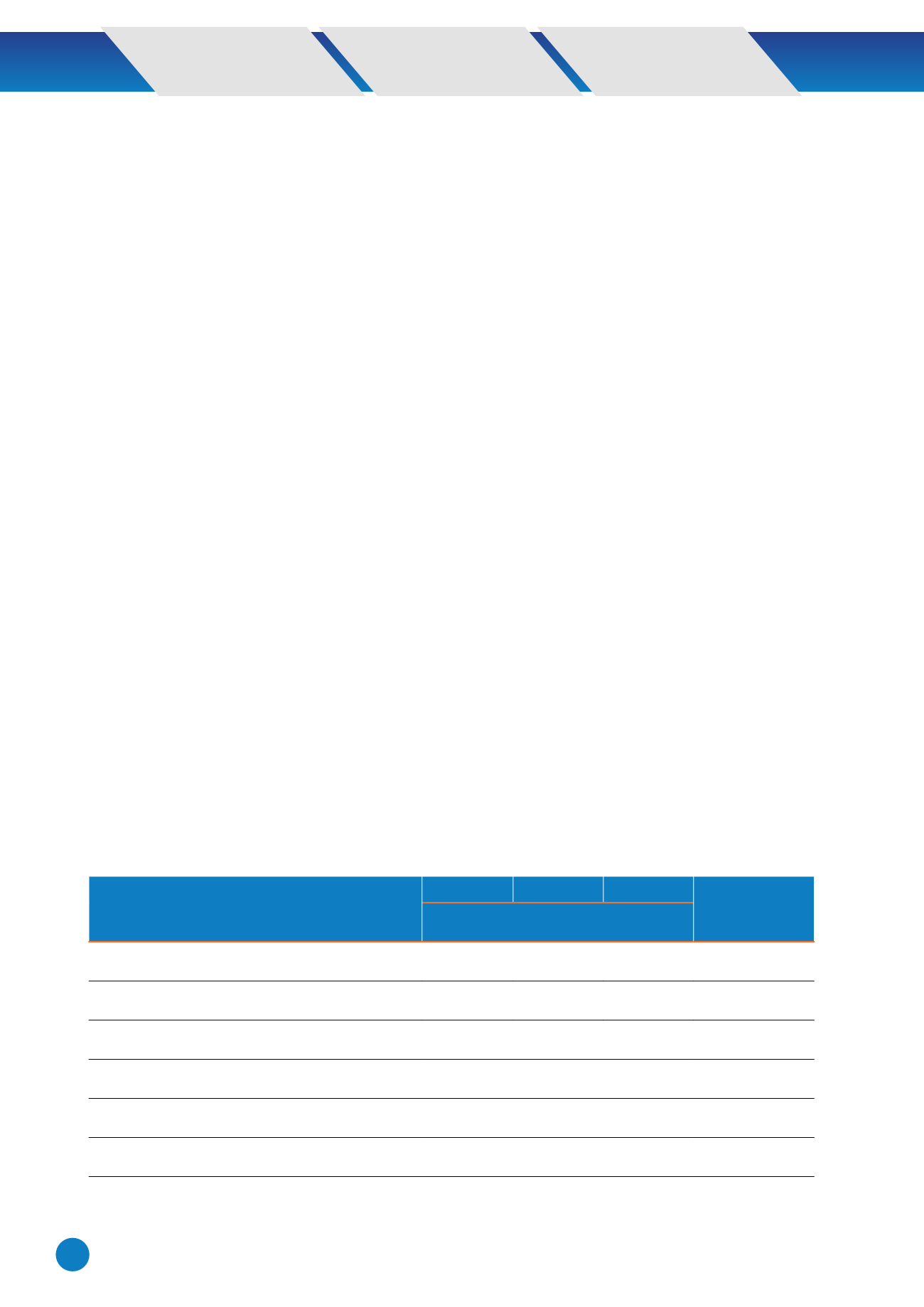

Laporan Laba Rugi Komprehensif Konsolidasian

Consolidated Statement of Comprehensive Profit or Loss

Laporan Laba Rugi Komprehensif

Comprehensive Statement of Profit or Loss

Uraian

Description

2020

2019

2018

% Pertumbuhan

2019-2020

Growth % in 2019-

2020

Dalam Juta Rupiah

In Million Rupiah

Pendapatan bersih

Net revenues

1.834.162

2.669.686

2.684.419

-31,30%

Beban pokok penjualan

Cost of goods sold

(1.475.151)

(2.101.710)

(2.242.169)

-29,81%

Laba (rugi) kotor

Gross profit (loss)

359.012

567.977

442.251

-36,79%

Beban usaha dan lain-lain

Operating expenses and others

(351.853)

(309.030)

(300.261)

13,86%

Laba (rugi) sebelum pajak penghasilan

Profit (loss) before income tax

7.158

258.947

141.990

-97,24%

Manfaat (beban) pajak penghasilan

Income tax benefit (expenses)

(4.375)

(50.698)

(39.024)

-91,37%