54

The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2015 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2015 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

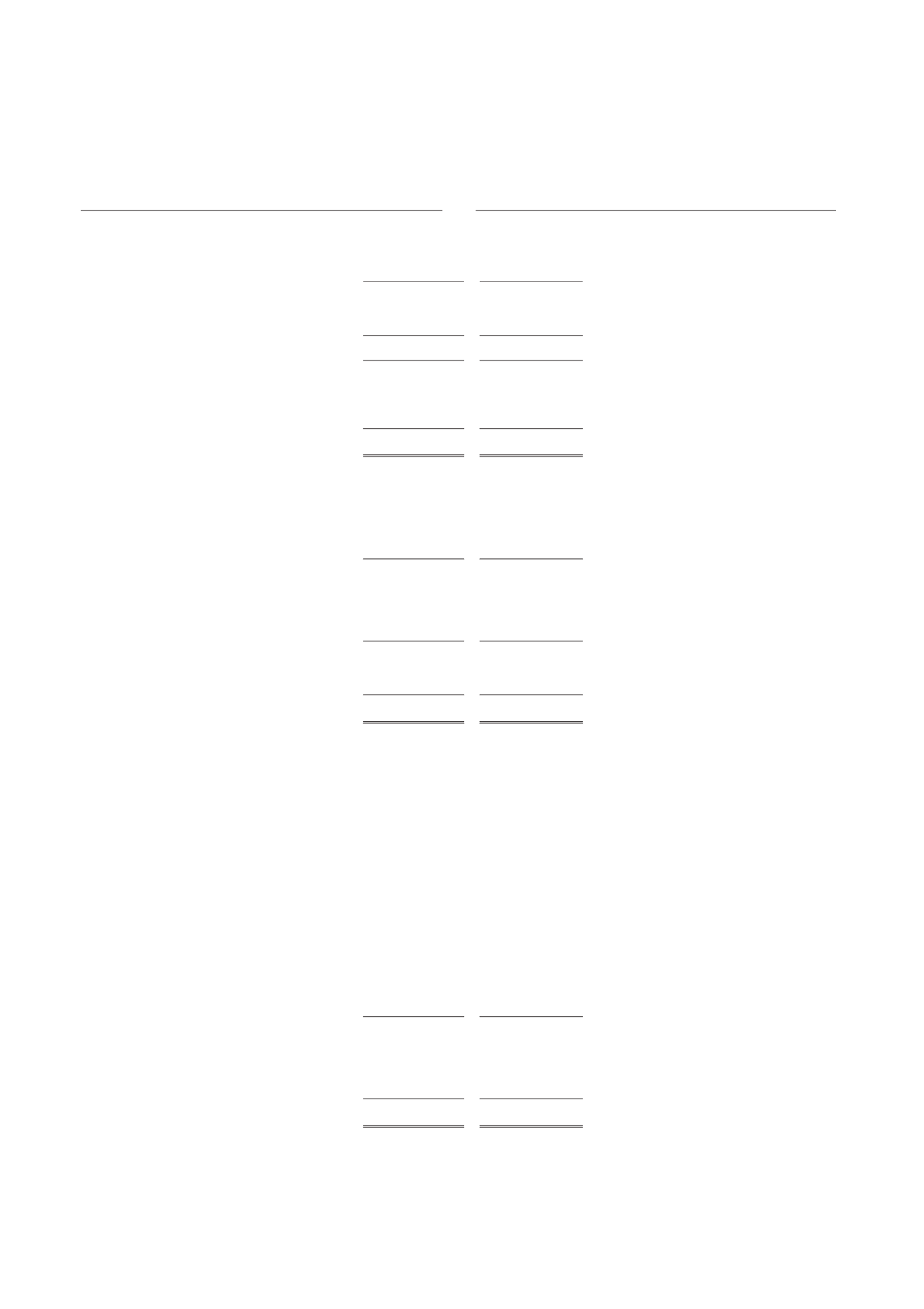

8. PIUTANG USAHA

8. TRADE RECEIVABLES

2015

2014

Pihak ketiga

500.192.073.268 547.617.339.718

Third parties

Dikurangi:

Less:

Cadangan kerugian penurunan nilai (9.193.297.592) (8.661.198.512)

Allowance for impairment loss

490.998.775.676 538.956.141.206

Pihak berelasi

Related parties

PT Alcarindo Prima

-

9.093.516

PT Alcarindo Prima

KSO PT Centra Multi Elektrindo -

KSO PT Centra Multi Elektrindo -

PT Voksel Electric Tbk

55.127.468.000

-

PT Voksel Electric Tbk

Total

546.126.243.676 538.965.234.722

Total

Rincian umur piutang usaha dihitung sejak tanggal

faktur adalah sebagai berikut:

Summary of the aging of accounts receivables

determined based on the date of invoice is as

follows:

2015

2014

Belum jatuh tempo

196.115.914.430 228.865.339.788

Not yet due

Telah jatuh tempo

Over due

1-30 hari

79.565.971.237 42.586.290.943

1-30 days

31-60 hari

21.836.778.322 12.616.724.172

31-60 days

Lebih dari 60 hari

257.800.877.279 263.558.078.331

More than 60 days

555.319.541.268 547.626.433.234

Dikurangi:

Less:

Cadangan kerugian penurunan nilai (9.193.297.592) (8.661.198.512)

Allowance for impairment loss

Total

546.126.243.676 538.965.234.722

Total

Pada tanggal 31 Desember 2015 dan 2014,

piutang usaha yang telah lewat jatuh tempo

namun tidak mengalami penurunan nilai terkait

dengan sejumlah pelanggan yang tidak memiliki

sejarah penghapusan piutang dan/atau memiliki

jaminan yang memadai. Berdasarkan pengalaman

masa lalu, manajemen berkeyakinan bahwa

cadangan atas penurunan nilai tidak diperlukan

karena tidak ada perubahan yang signifikan

terhadap kualitas kredit dan saldo piutang

dianggap dapat seluruhnya dipulihkan.

As of December 31, 2015 and 2014, trade

receivables that were past due but not impaired

related to a number of independent customers for

whom there is no history of write-off and/or have

sufficient collateral. Based on past experience, the

management believes that no allowance for

impairment is necessary in respect of these

balances as there has not been a significant

change in credit quality and the balances are still

considered fully recoverable.

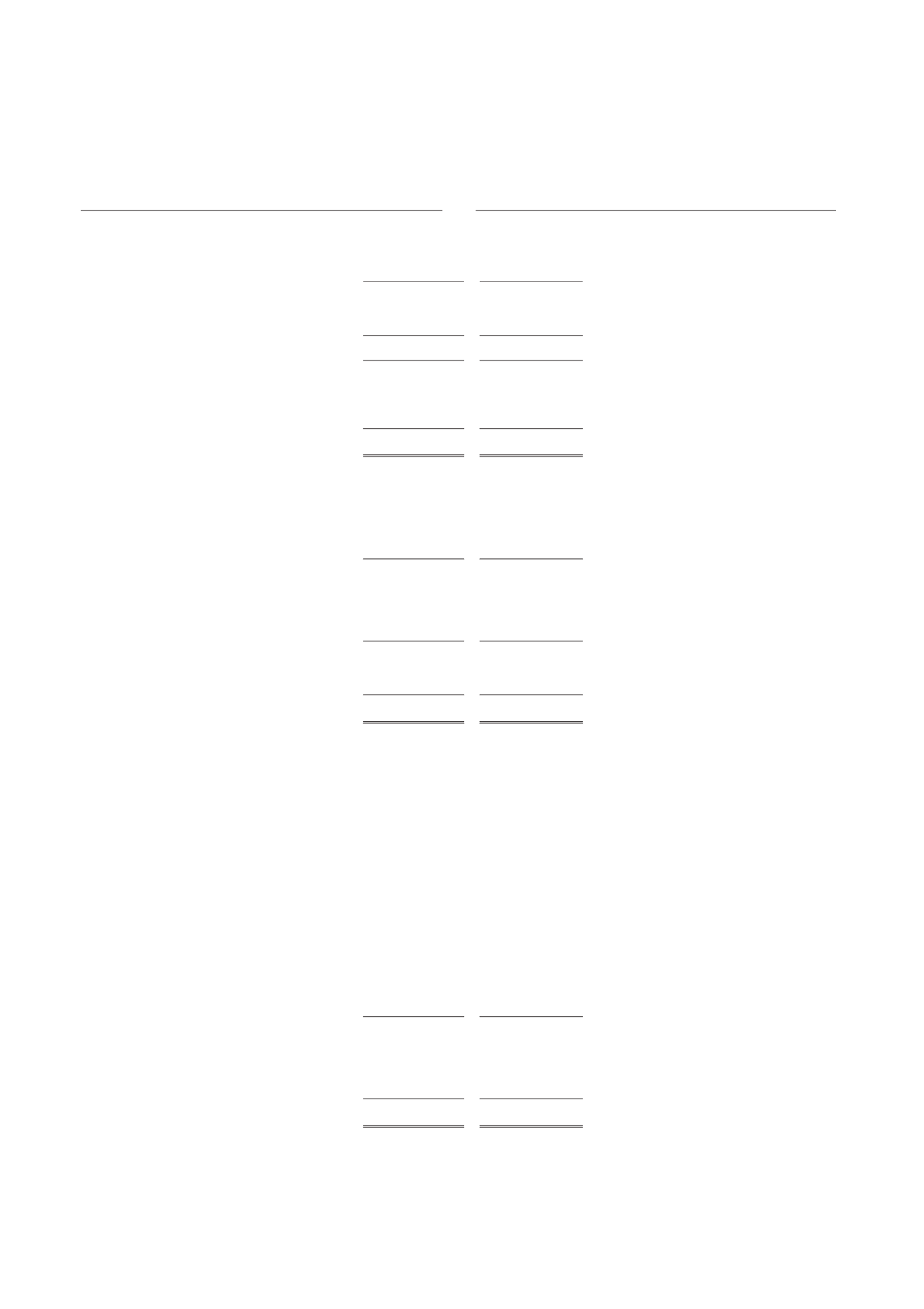

Analisis perubahan cadangan penurunan nilai

piutang usaha adalah sebagai berikut:

Analysis of changes in the allowance for

impairment loss of trade receivables are as

follows:

2015

2014

Saldo awal

8.661.198.512

8.815.363.512

Beginning balance

Penambahan cadangan kerugian

Addition allowance for impairment

penurunan nilai

532.099.080

180.901.188

loss

Penghapusan cadangan kerugian

Written off allowance for impairment

penurunan nilai

-

(335.066.188)

loss

Saldo akhir tahun

9.193.297.592

8.661.198.512

Year end balance

Penyisihan penurunan nilai ditinjau secara berkala

terhadap kemungkinan debitur mengalami

kesulitan keuangan yang signifikan, mengalami

pailit, wanprestasi atau tunggakan pembayaran.

Provision for impairment is reviewed periodically

for the possibility of debtor facing significant

financial difficulties, entering bankruptcy, payment

default or delinquent payment.