59

The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2015 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2015 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

13. ASET TETAP (lanjutan)

13. FIXED ASSETS (continued)

Pada tanggal 31 Desember 2015 dan 2014,

Perusahaan mengasuransikan mesin dan

peralatan pada PT Asuransi Jasa Tania Tbk

terhadap risiko kebakaran dan risiko lainnya

dengan jumlah nilai pertanggungan masing-

masing

sebesar

USD3.379.017,72

dan

EUR193.000,

dan

juga

mengasuransikan

bangunan Menara Karya terhadap risiko

kebakaran dan risiko lainnya dengan jumlah nilai

pertanggungan

masing-masing

sebesar

Rp3.689.600.000.

Manajemen

berpendapat

bahwa nilai pertanggungan tersebut cukup

memadai untuk menutup kemungkinan kerugian

yang

timbul

atas

risiko-risiko

yang

dipertanggungkan tersebut.

As of December 31, 2015 and 2014, the Company

insured machinery and equipment to PT Asuransi

Jasa Tania Tbk against losses by fire and other

risks with total insurance coverage amounting

to

USD3,379,017.72

and

EUR193,000,

respectively and also insured building in Menara

Karya against losses by fire and other risks with

total

insurance

coverage

amounting

to

Rp3,689,600,000, respectively. Management

believes that the amount of insurance coverage is

adequate to cover any possible losses that may

arise from the insured risks.

14. ASET TETAP YANG TIDAK DIGUNAKAN DARI

OPERASI YANG DIHENTIKAN

14. UNUSED

FIXED

ASSETS

FROM

DISCONTINUED OPERATION

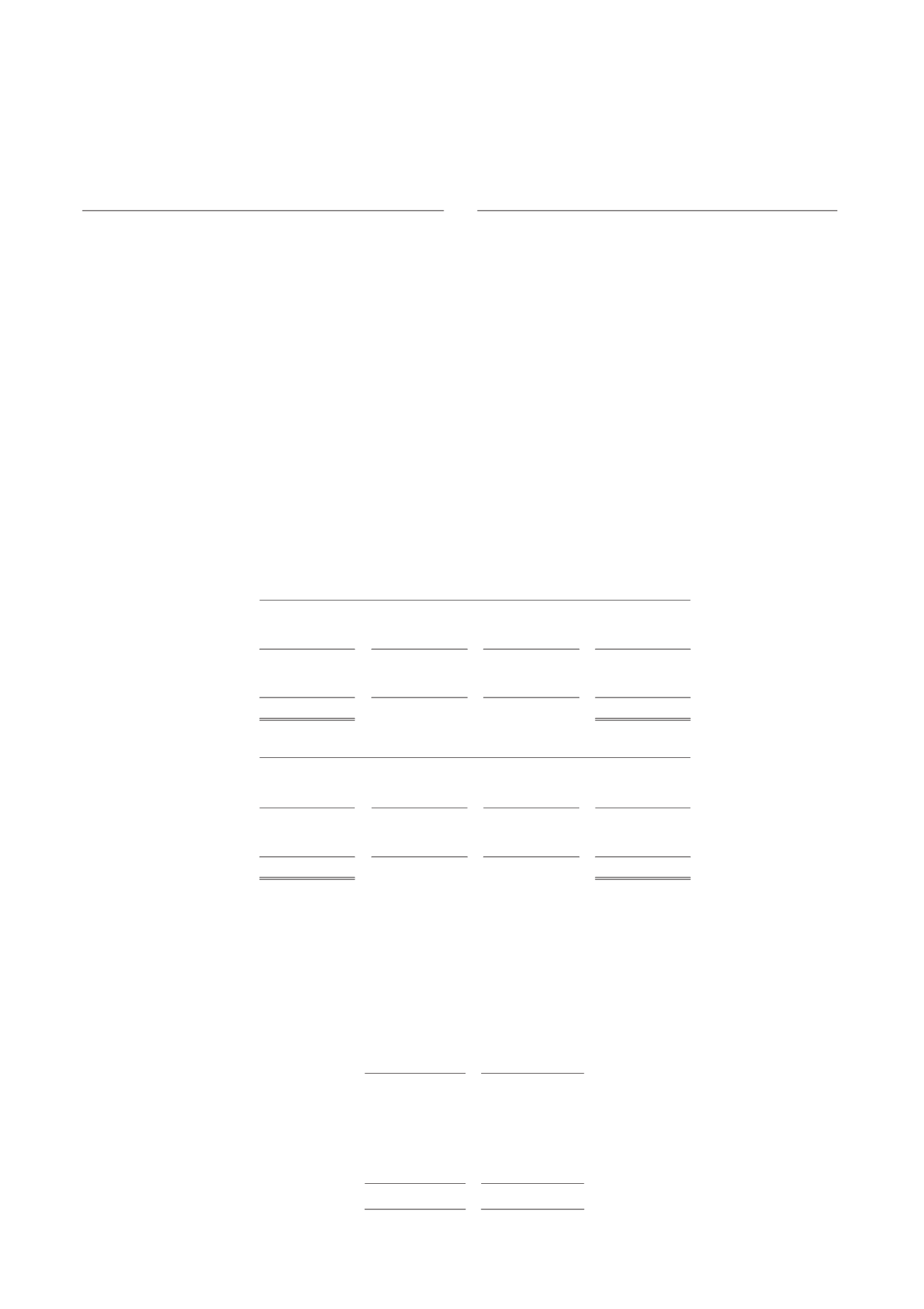

2015

Saldo awal /

Saldo akhir /

Beginning

Penambahan /

Pengurangan /

Ending

balance

Addition

Deduction

balance

Harga perolehan gedung

3.176.748.084

-

-

3.176.748.084

Acquisition cost of buliding

Akumulasi penyusutan

Accumulated depreciation

gedung

(3.158.382.350)

(13.201.630)

-

(3.171.583.980)

building

Nilai tercatat neto

18.365.734

5.164.104

Net carrying amount

2014

Saldo awal /

Saldo akhir /

Beginning

Penambahan /

Pengurangan /

Ending

balance

Addition

Deduction

balance

Harga perolehan gedung

3.176.748.084

-

-

3.176.748.084

Acquisition cost of buliding

Akumulasi penyusutan

Accumulated depreciation

gedung

(3.125.763.518)

(32.618.832)

-

(3.158.382.350)

building

Nilai tercatat neto

50.984.566

18.365.734

Net carrying amount

Penyusutan aset tetap yang tidak digunakan dari

operasi dalam penghentian diakui pada laporan

laba rugi konsolidasian masing-masing sebesar

Rp13.201.630 dan Rp32.618.832 pada tahun

2015 dan 2014, dicatat pada akun “Beban lain-

lain”.

Depreciation of unused asset is recognized in

consolidated statement of profit or loss amounted

to Rp13,201,630 and Rp32,618,832, respectively,

in 2015 and 2014 and recorded as “Other

expenses”.

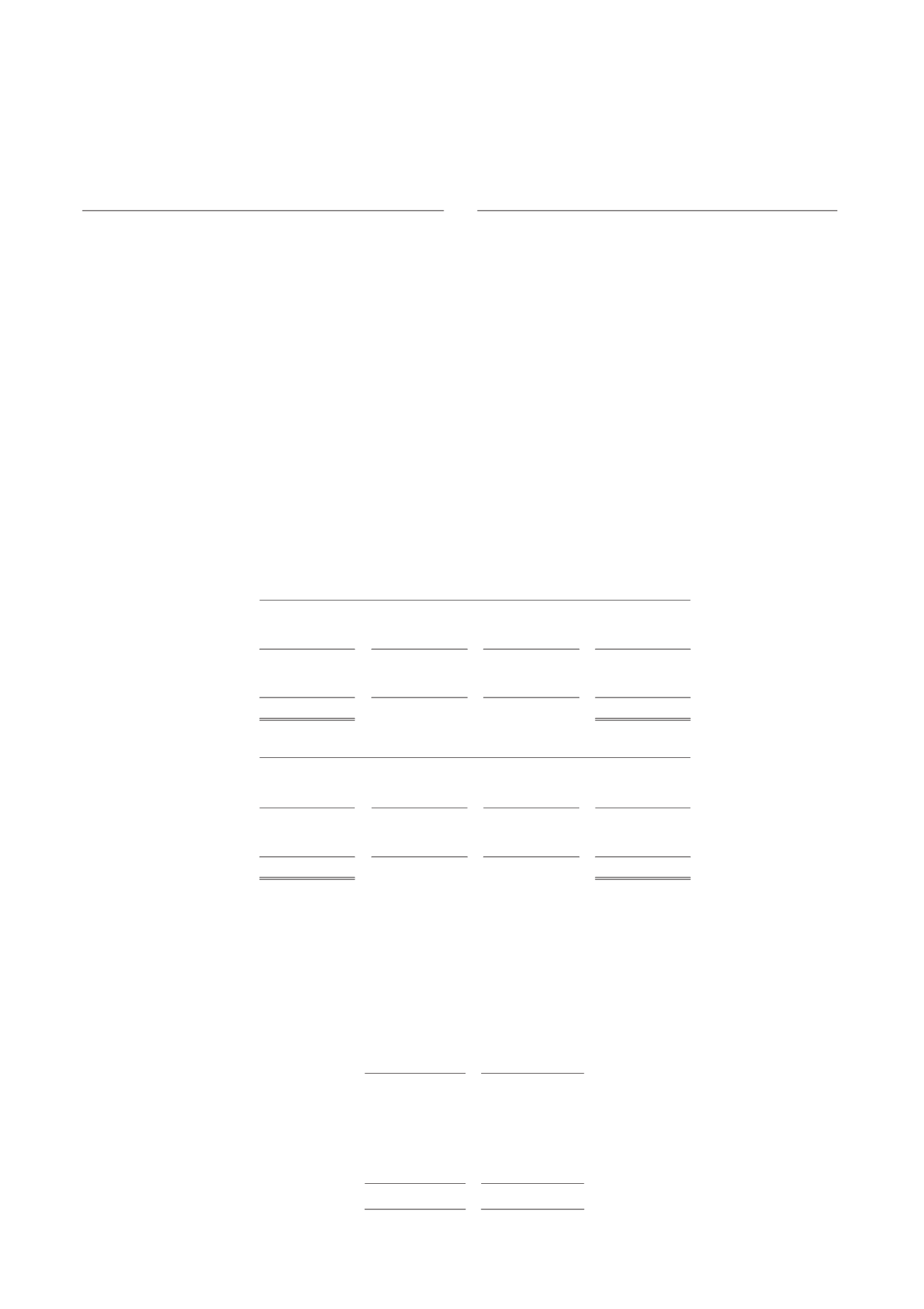

15. ASET TIDAK LANCAR LAINNYA

15. OTHER NON-CURRENT ASSETS

2015

2014

Pihak ketiga:

Third parties:

Asuransi Manulife

1.541.869.436

1.452.248.136

Manulife insurance

Jaminan bea cukai

2.313.090.000

1.086.051.000

Custom clearance deposits

Jaminan PT PLN (Persero)

539.628.000

539.628.000

Deposit to PT PLN (Persero)

Receivables from management and

Piutang pengurus dan karyawan

612.300.357

538.082.133

employees

Lain-lain

336.622.892

3.426.257.627

Others

Total

5.343.510.685

7.042.266.896

Total