The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2014 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2014 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

48

7. PIUTANG USAHA (lanjutan)

7. TRADE RECEIVABLES (continued)

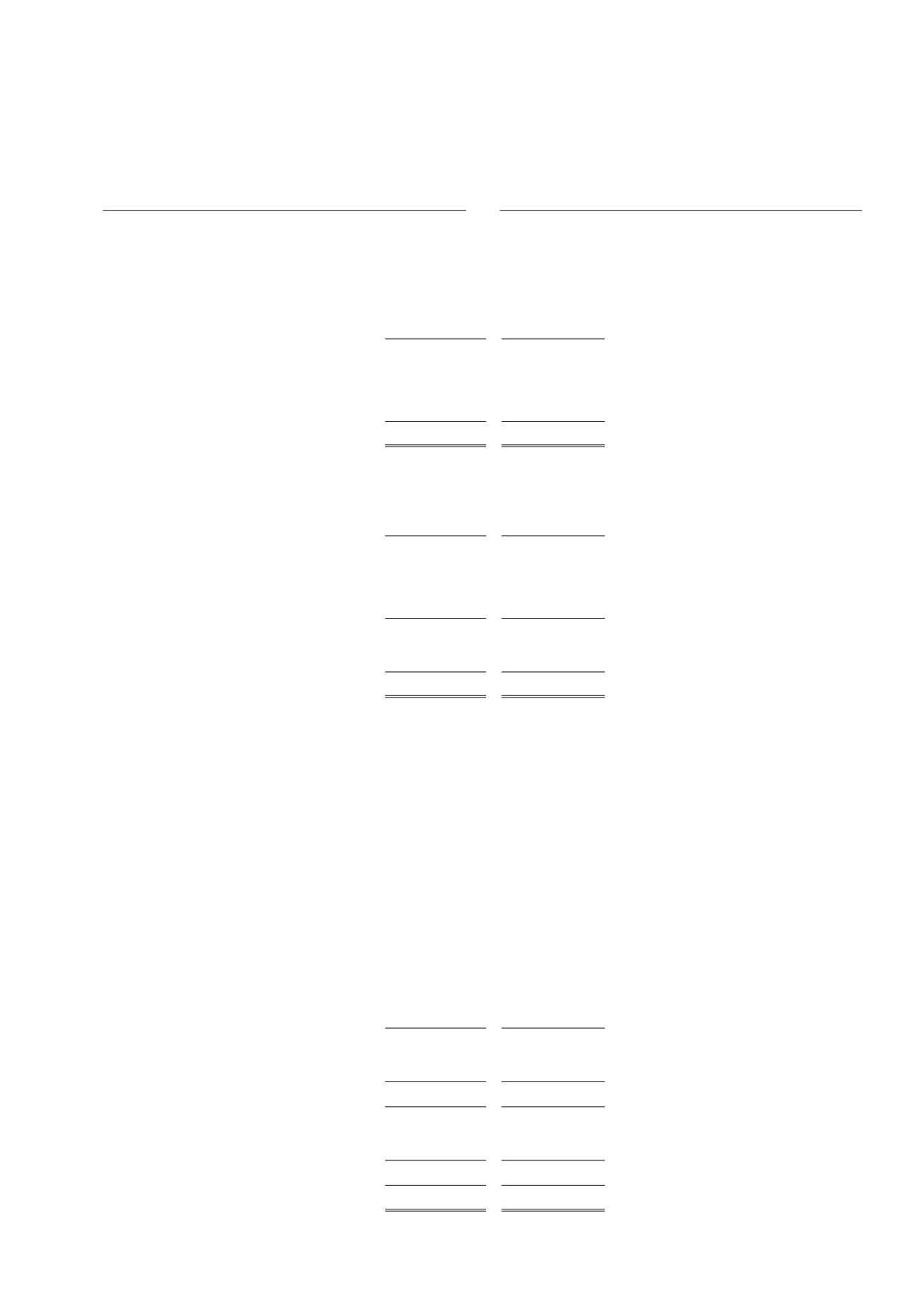

Analisis perubahan cadangan penurunan nilai

piutang usaha adalah sebagai berikut:

Analysis of changes in the allowance for

impairment loss of trade receivables are as

follows:

2014

2013

Saldo awal

8.815.363.512

8.536.342.417

Beginning balance

Penambahan cadangan kerugian

Addition allowance for impairment

penurunan nilai

180.901.188

279.021.095

loss

Penghapusan cadangan kerugian

Written off allowance for impairment

penurunan nilai

(335.066.188)

-

loss

Saldo akhir tahun

8.661.198.512

8.815.363.512

Year end balance

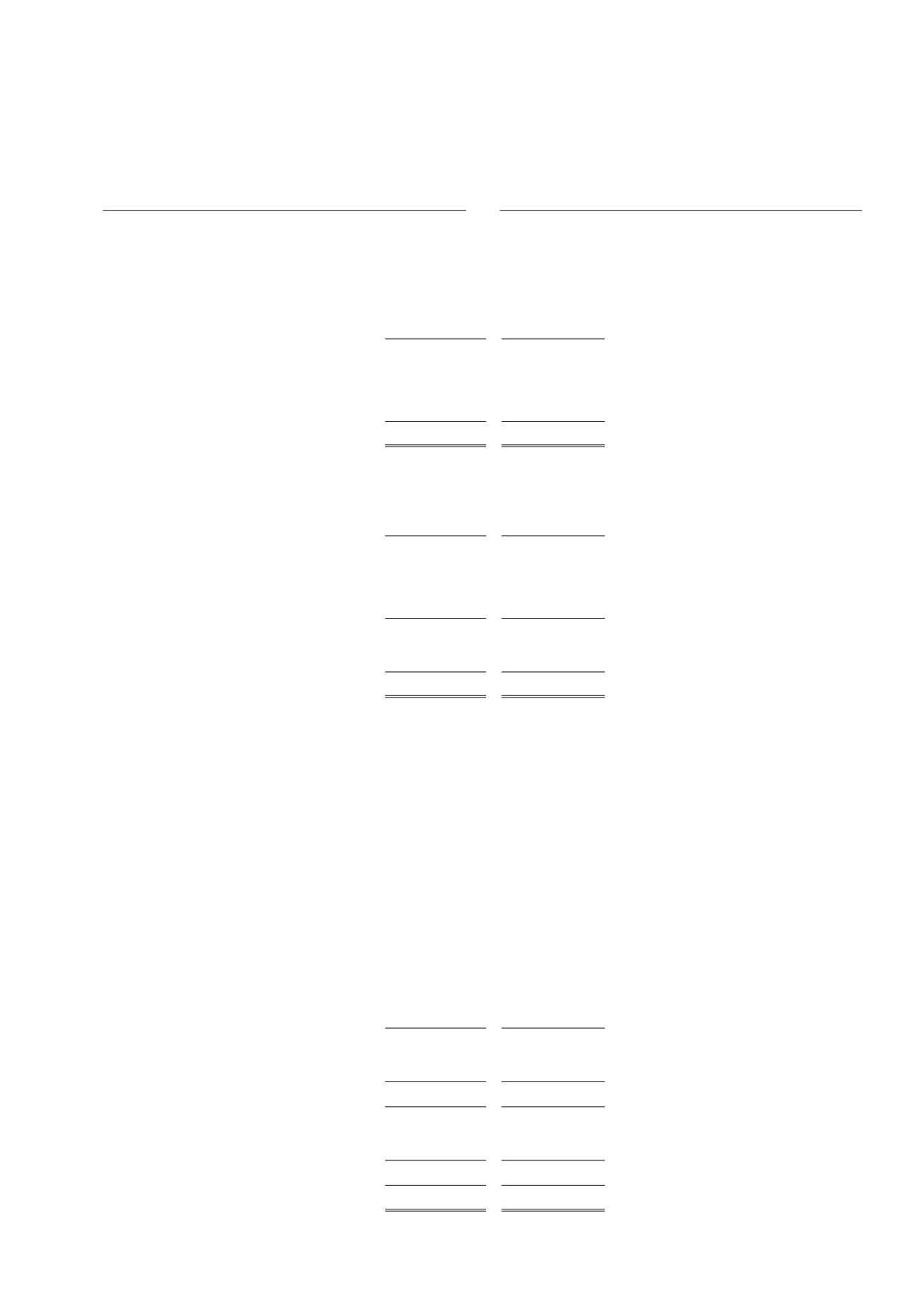

Rincian piutang usaha menurut jenis mata uang

adalah sebagai berikut:

The details of accounts receivables based on

currencies are as follows:

2014

2013

Rupiah

499.323.634.681 603.794.869.122

Rupiah

Mata Uang Asing

Foreign Currency

(31 Desember 2014:USD3.882.861,62;

(December 31, 2014:USD3,882,861.62;

dan 31 Desember 2013:

and Desember 31, 2013:

USD24.063.475,65)

48.302.798.553 293.309.704.719

USD24,063,475.65)

547.626.433.234 897.104.573.841

Dikurangi:

Less:

Cadangan kerugian penurunan nilai (8.661.198.512) (8.815.363.512)

Allowance for impairment loss

Total

538.965.234.722 888.289.210.329

Total

Penyisihan penurunan nilai ditinjau secara berkala

terhadap kemungkinan debitur mengalami

kesulitan keuangan yang signifikan, mengalami

pailit, wanprestasi atau tunggakan pembayaran.

Provision for impairment is reviewed periodically

for the possibility of debtor facing significant

financial difficulties, entering bankruptcy, payment

default or delinquent payment.

Manajemen berkeyakinan bahwa penyisihan

penurunan nilai piutang telah memadai untuk

menutupi kemungkinan kerugian dari tidak

tertagihnya piutang usaha.

Management believes the above allowance for

impairment loss of accounts receivables is

adequate to cover possible losses that may arise

from the non-collectible accounts receivables.

Pada tanggal 31 Desember 2014, sejumlah

piutang usaha senilai minimal 100% dari limit kredit

yang diterima dari PT Bank Mandiri (Persero) Tbk.

dijadikan sebagai jaminan atas pinjaman bank

jangka pendek (Catatan 16).

As of December 31, 2014, trade receivables

amounting to minimum of 100% from credit limit

received from PT Bank Mandiri (Persero) Tbk have

been pledged as a collateral of short-term bank

loans (Note 16).

8. PIUTANG LAIN-LAIN

8. OTHER RECEIVABLES

2014

2013

Pihak ketiga:

Third parties:

Deposito jaminan

55.377.127.663 87.442.685.476

Guarantee deposits

Lain-lain

689.508.041

1.113.722.391

Others

56.066.635.704 88.556.407.867

Pihak berelasi:

Related parties:

PT Alcarindo Prima

337.187.774

337.187.774

PT Alcarindo Prima

SWCC Showa Holdings Co., Ltd.

93.993.602

93.993.602

SWCC Showa Holdings Co., Ltd.

431.181.376

431.181.376

Total

56.497.817.080 88.987.589.243

Total