The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2014 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2014 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

49

8. PIUTANG LAIN-LAIN (lanjutan)

8. OTHER RECEIVABLES (continued)

Deposito jaminan diatas merupakan marginal

deposit sehubungan dengan fasilitas Letter of

Credit (L/C) yang diberikan PT Bank Mandiri

(Persero) Tbk kepada Perusahaan (Catatan 16).

Guarantee deposit are marginal deposit in relation

with Letter of Credit (L/C) facility given by

PT Bank Mandiri (Persero) Tbk to the Company

(Note 16).

Berdasarkan hasil penelaahan kolektibilitas akun

piutang lain-lain masing-masing pelanggan pada

akhir tahun, Manajemen berpendapat tidak perlu

membentuk penyisihan kerugian penurunan nilai

karena berkeyakinan seluruh piutang dapat

tertagih.

Based on the review of collectibility of the

individual other receivable account at the end of

the years, Management believes that it is not

necessary to provide allowance for impairment

loss since all receivables are collectible.

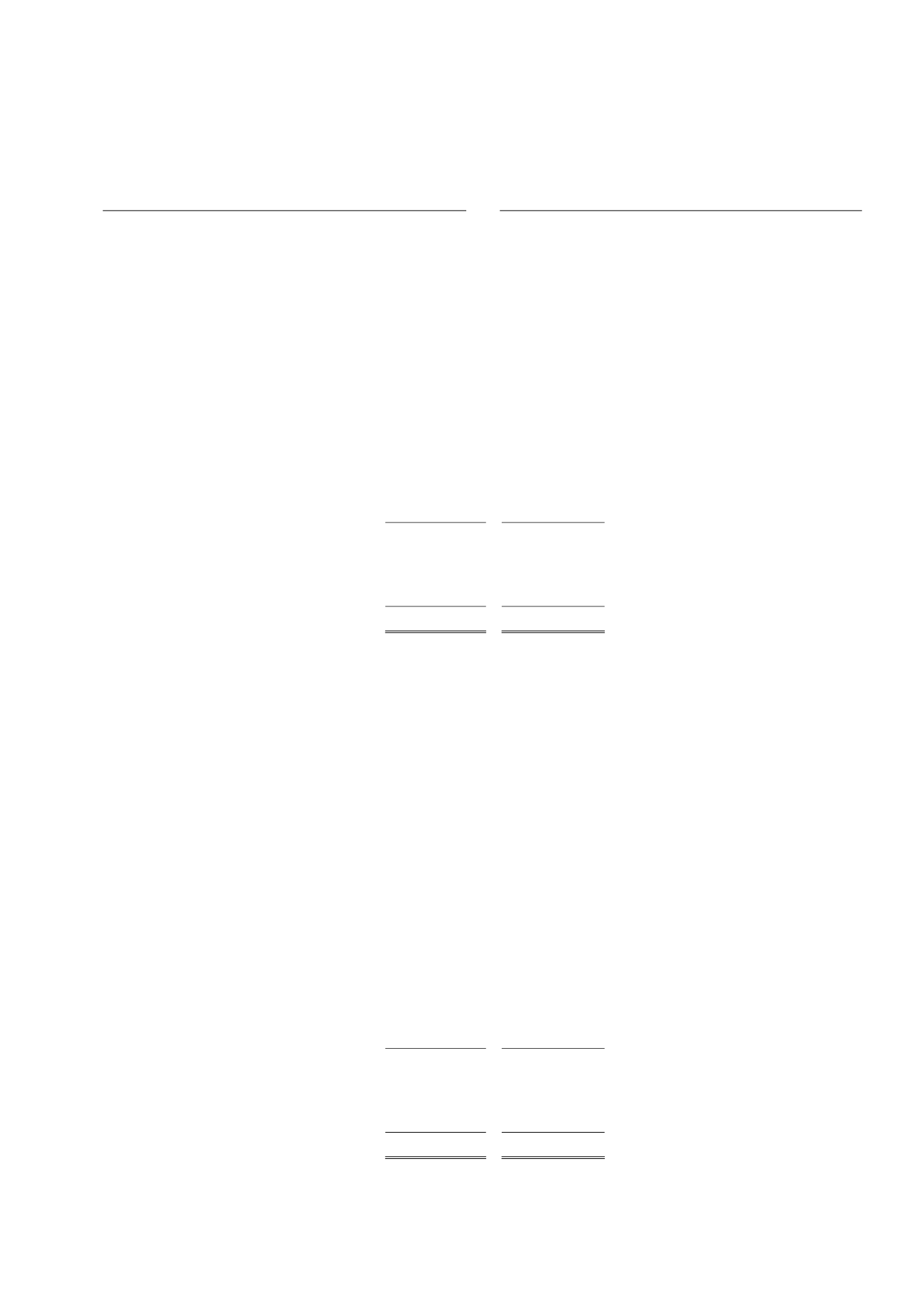

9. PERSEDIAAN

9. INVENTORIES

2014

2013

Barang jadi

197.435.044.270 156.353.228.524

Finished goods

Bahan baku

102.827.475.951 95.252.856.082

Raw materials

Barang dalam proses

115.076.066.794 91.320.455.458

Work in process

Bahan pembantu

19.650.842.799 19.265.649.968

Supplies

Suku cadang

2.899.677.201

3.609.256.306

Spare parts

Total

437.889.107.015 365.801.446.338

Total

Pada tanggal 31 Desember 2014 dan 2013,

persediaan diasuransikan masing-masing pada

PT Astra Buana dan PT Asuransi Wahana Tata,

terhadap risiko kebakaran dan risiko lainnya

dengan nilai pertanggungan masing-masing

sebesar Rp397,9 milyar. Manajemen berpendapat

bahwa nilai pertanggungan tersebut cukup

memadai untuk menutup kemungkinan kerugian

yang

timbul

atas

risiko-risiko

yang

dipertanggungkan tersebut.

As of December 31, 2014 and 2013, inventories

are covered by insurance with PT Astra Buana and

PT Asuransi Wahana Tata, respectively, against

losses by fire and other risks with total sum

insured of Rp397.9 billion, respectively.

Management believes that the amounts of

insurance coverage are adequate to cover any

possible losses that may arise.

Pada tanggal 31 Desember 2014 dan 2013,

seluruh persediaan dijadikan sebagai jaminan atas

pinjaman bank jangka pendek PT Bank Mandiri

(Persero) Tbk (Catatan 16).

As of December 31, 2014 and 2013, all inventories

are used as collateral for short-term bank loans

with PT Bank Mandiri (Persero) Tbk (Note 16).

Manajemen berpendapat bahwa nilai tercatat

persediaan pada tanggal 31 Desember 2014 dan

2013 telah mencerminkan nilai realisasi bersihnya.

Management believes that the carrying value of

the inventory as of December 31, 2014 and 2013

has reflected the net realizable value.

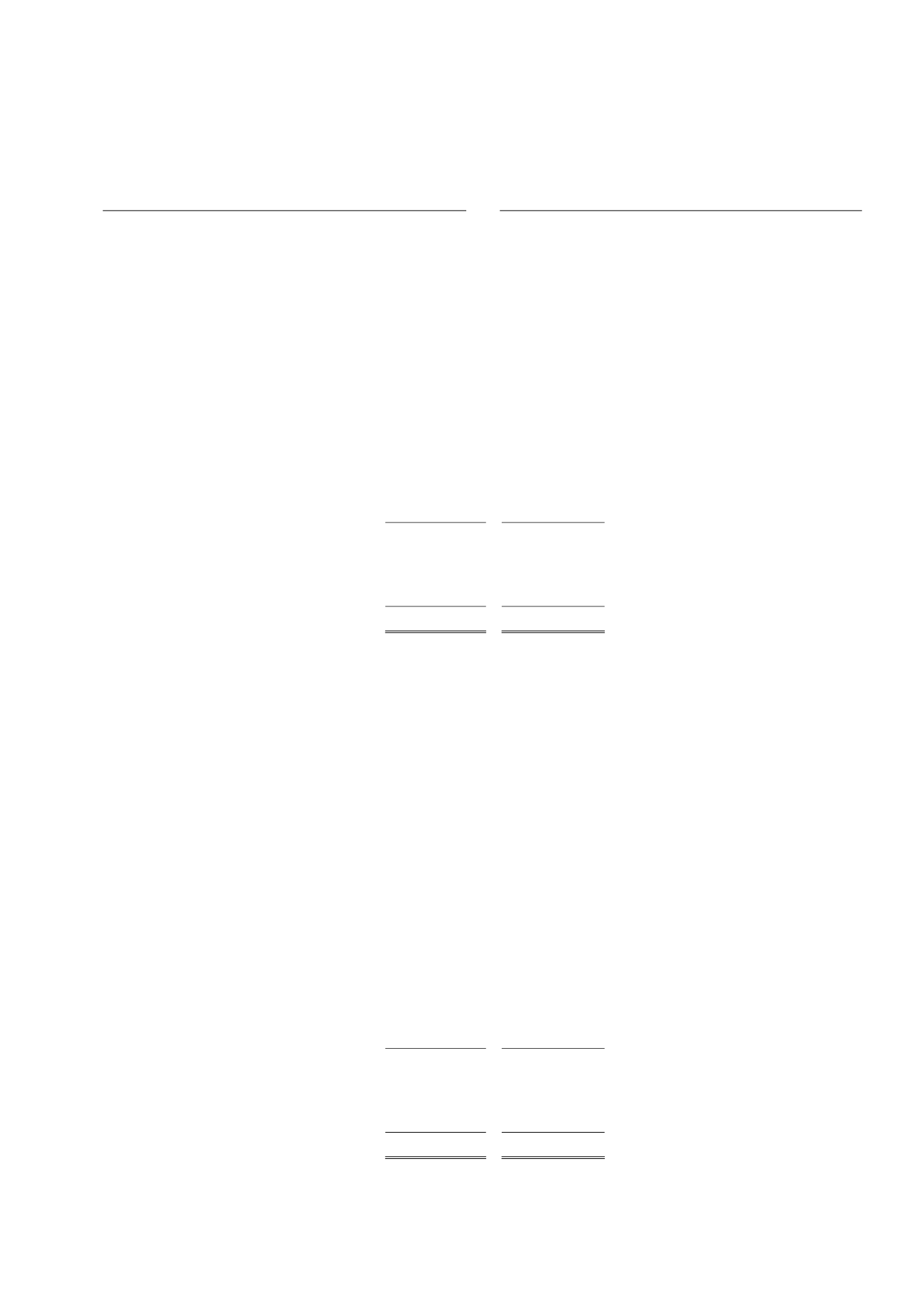

10. ASET LANCAR LAINNYA

10. OTHER CURRENT ASSETS

2014

2013

Uang muka pembelian lokal

10.524.497.681 12.385.051.230

Advances purchase for local

Uang muka pembelian impor

2.172.690.021 11.315.944.803

Advances purchase for import

Provisi bank

1.204.826.389

616.666.667

Bank provision

Asuransi dibayar dimuka

616.321.742

517.392.871

Prepaid insurance

Lain-lain

1.182.663.104

475.030.949

Others

Total

15.700.998.937 25.310.086.520

Total