The original consolidated financial statements included herein are in

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

31 Desember 2019 dan 2018 dan untuk tahun-tahun

yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

December 31, 2019 and 2018

and for the years then ended

(Expressed in Rupiah, unless otherwise stated)

80

21. PERPAJAKAN

21. TAXATION

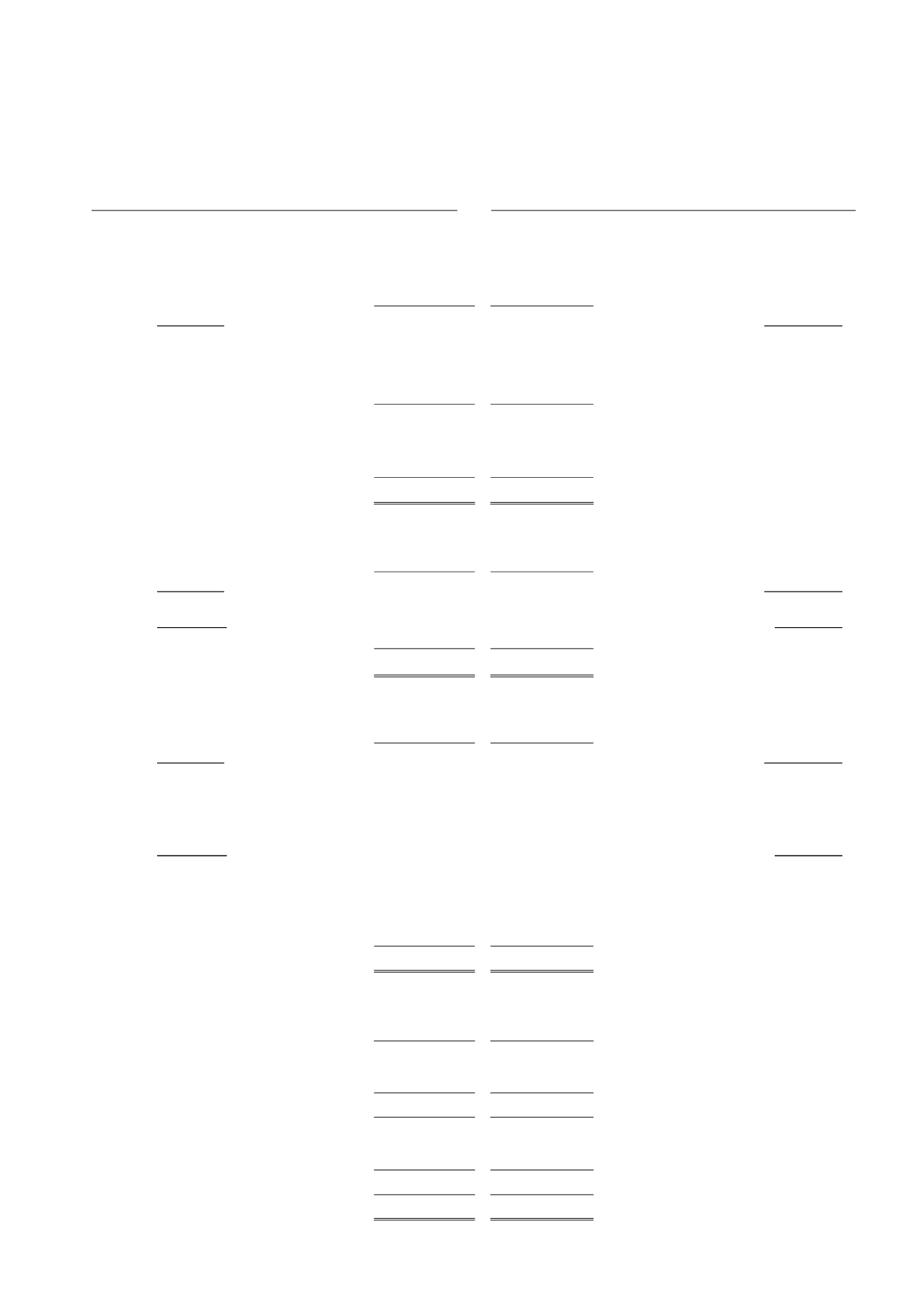

a. Estimasi Tagihan Pajak

a. Estimated Claims for Tax Refund

2019

2018

Perusahaan

The Company

Pajak Penghasilan Badan 2018

7.803.384.235

7.803.384.235

Corporate Income Tax 2018

Pajak Penghasilan Badan 2019

7.343.607.807

-

Corporate Income Tax 2019

PPN 2019

7.933.256.292

-

VAT 2019

PPN 2018

- 13.320.671.664

VAT 2018

PPN 2017

- 21.111.258.108

VAT 2017

23.080.248.334 42.235.314.007

Dikurangi estimasi tagihan pajak

yang jatuh tempo dalam

Less current maturities of

waktu satu tahun

7.803.384.235 34.431.929.772

estimated claims for tax refund

Bagian jangka panjang

15.276.864.099

7.803.384.235

Long-term portion

b. Pajak Dibayar di Muka

b. Prepaid Taxes

2019

2018

Perusahaan

The Company

Pajak Pertambahan Nilai

23.705.986.364 48.787.222.729

Value Added Tax

Entitas Anak

Subsidiaries

Pajak Pertambahan Nilai

12.759.069.505 13.677.631.290

Value Added Tax

Total

36.465.055.869 62.464.854.019

Total

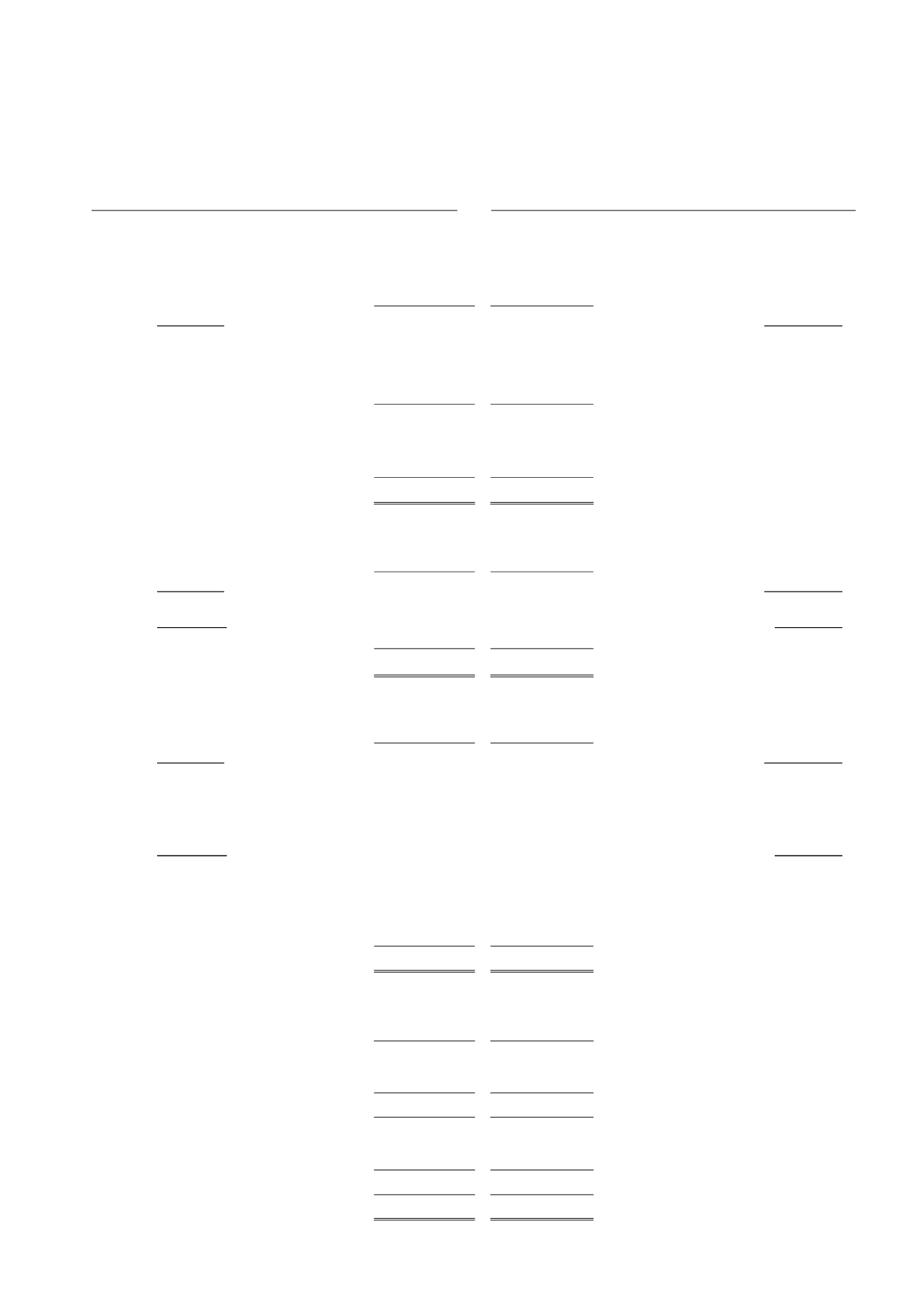

c. Utang Pajak

c. Taxes Payable

2019

2018

Perusahaan

The Company

Pajak Penghasilan Pasal 21

552.367.524

454.253.442

Income Tax Article 21

Pajak Penghasilan Pasal 23

-

97.458.598

Income Tax Article 23

Pajak Penghasilan Pasal 25

995.661.739

-

Income Tax Article 25

Pajak Penghasilan Pasal 26

732.365.943

31.697.564

Income Tax Article 26

Pajak Penghasilan Pasal 4 ayat 2

303.661.771

322.207.792

Income Tax Article 4 (2)

4

Entitas Anak

Subsidiaries

Pajak Penghasilan Pasal 21

130.730.644

362.397.115

Income Tax Article 21

Pajak Penghasilan Pasal 23

36.160.796

18.781.326

Income Tax Article 23

Pajak Penghasilan Pasal 25

383.670.486

317.088.734

Income Tax Article 25

Pajak Penghasilan Pasal 29

4.081.977.449

1.037.019.462

Income Tax Article 29

Pajak Penghasilan Pasal 4 ayat 2

1.267.136.497

817.120.064

Income Tax Article 4 (2)

Pajak Pertambahan Nilai

339.799.057

9.454.020.466

Value Added Tax

Total

8.823.531.906 12.912.044.563

Total

d. Beban (Manfaat) Pajak

d. Tax Expenses (Benefit)

2019

2018

Pajak kini:

Current tax:

Perusahaan

49.393.651.400 34.140.110.500

The Company

Entitas Anak

9.409.104.972

4.883.822.814

Subsidiaries

58.802.756.372 39.023.933.314

Pajak tangguhan:

Deferred tax:

Perusahaan

(6.610.484.404) (1.040.328.395)

The Company

Entitas Anak

(1.494.275.686) (1.462.394.653)

Subsidiaries

(8.104.760.090) (2.502.723.048)

Beban pajak konsolidasian

50.697.996.282 36.521.210.266

Consolidated tax expenses