The original consolidated financial statements included herein are in

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

31 Desember 2019 dan 2018 dan untuk tahun-tahun

yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

December 31, 2019 and 2018

and for the years then ended

(Expressed in Rupiah, unless otherwise stated)

83

21. PERPAJAKAN (lanjutan)

21. TAXATION (continued)

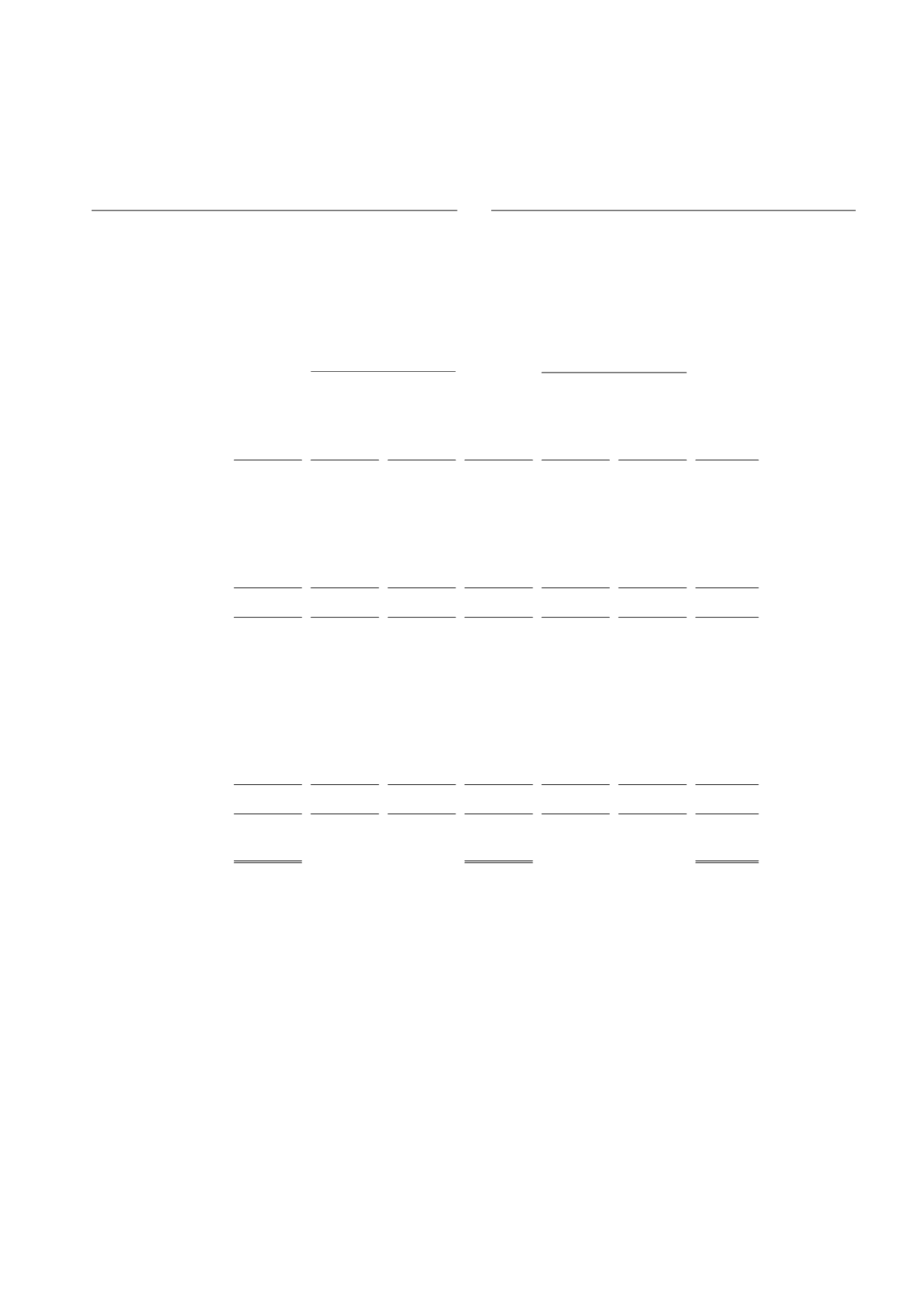

e. Pajak Tangguhan

e. Deferred Tax

Rincian dari aset pajak tangguhan Grup pada

tanggal 31 Desember 2019 dan 2018 adalah

sebagai berikut:

Summary of deferred tax assets Group dated

December 31, 2019 and 2018 are as follows:

2018

2019

Dikreditkan Dikreditkan

Dikreditkan

(dibebankan) ke penghasilan

(dibebankan) Dibebankan

ke laporan komprehensif

ke laporan ke penghasilan

laba rugi/

lain/

laba rugi/

komprehensif lain/

Charged

Credited

Charged

Charged

(credited)

to other

(credited)

to other

1 Jan. 2018/

to statement of

comprehensive

31 Des. 2018

to statement of comprehensive

31 Des. 2019/

Jan. 1, 2018

profit or loss

income

Dec. 31, 2018

profit or loss

income

Dec. 31, 2019

Perusahaan

The Company

Aset (liabilitas)

Deferred tax

pajak tangguhan:

assets (liabilities):

Imbalan kerja

Post employment

karyawan

8.219.074.244 1.057.119.954

(945.440.463) 8.330.753.735 1.170.673.033

90.248.459 9.591.675.227

benefit

Kerugian penurunan

Loss on impairment

nilai piutang

3.768.544.613 1.238.925.267

- 5.007.469.880 4.004.408.129

- 9.011.878.009

receivables

Depreciation of

Penyusutan

property, plant

aset tetap

(258.707.204)

11.537.668

-

(247.169.536)

208.399.208

-

(38.770.328)

and equipment

Sewa pembiayaan

(468.472.238)

(69.020.486)

-

(537.492.724)

(643.666.445)

- (1.181.159.169)

Finance leases

Provisi bonus

3.000.000.000 (1.198.234.008)

- 1.801.765.992 1.870.670.479

- 3.672.436.471

Provision for bonus

Aset (Liabilitas)

Deferred Tax Assets

Pajak Tangguhan 14.260.439.415 1.040.328.395

(945.440.463) 14.355.327.347

6.610.484.404

90.248.459 21.056.060.210

(Liabilities)

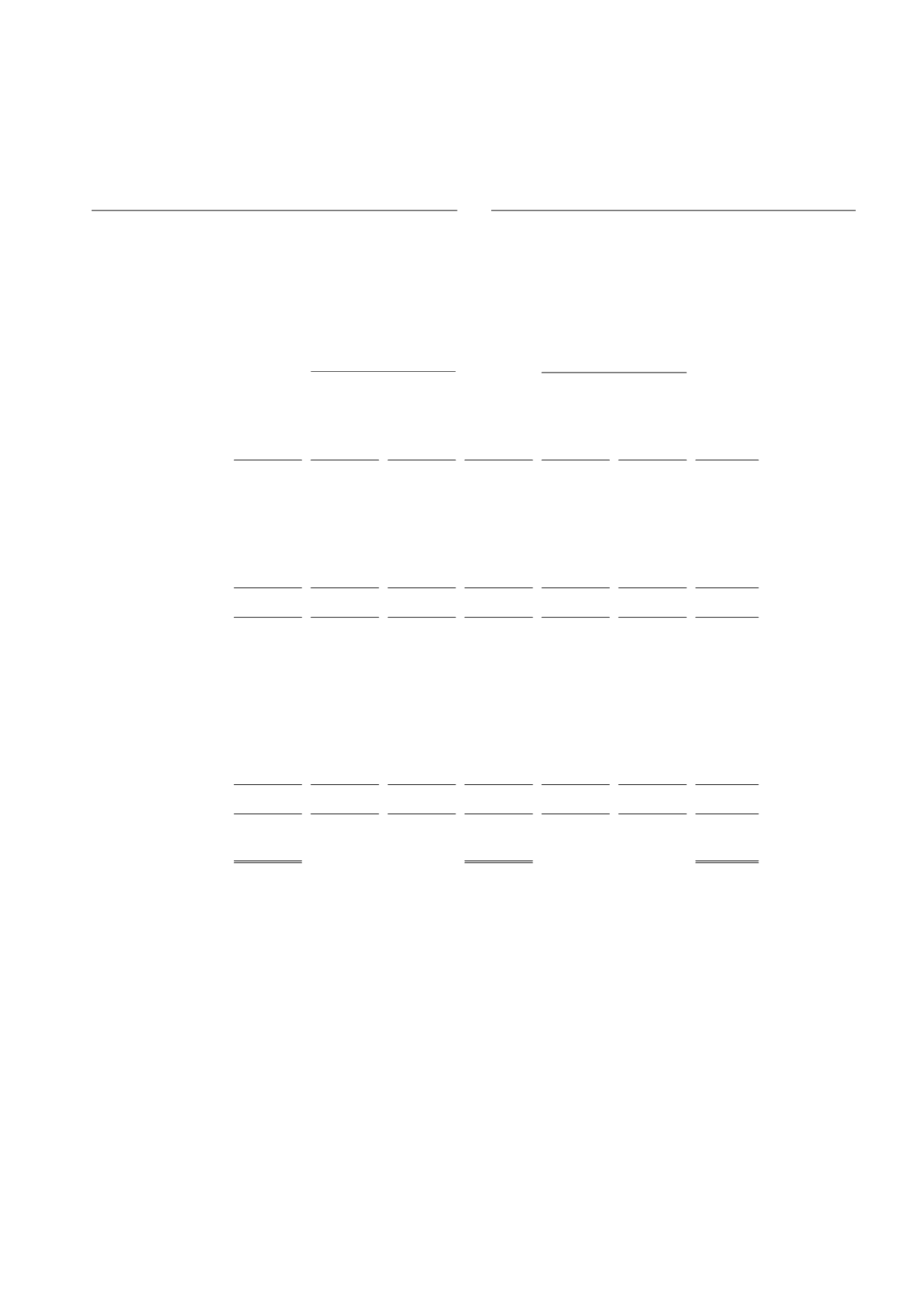

Entitas Anak

Subsidiaries

Aset (liabilitas)

Deferred tax

pajak tangguhan:

assets (liabilities):

Imbalan kerja

Post employment

karyawan

467.609.410

102.509.833

(67.416.803)

502.702.440

418.505.949

70.602.629

991.811.018

benefits

Kerugian penurunan

Loss on impairment

nilai piutang

-

-

-

- 1.591.945.910

- 1.591.945.910

receivables

Depreciation of

Penyusutan

property, plant

aset tetap

(2.819.691.475)

34.375.198

- (2.785.316.277)

406.900.843

- (2.378.415.434)

and equipment

Sewa pembiayaan (114.877.936)

27.880.213

-

(86.997.723)

86.997.723

-

-

Finance leases

Provisi bonus

11.817.237

180.067.961

-

191.885.198

107.486.709

-

299.371.907

Provision for bonus

Laba proyek dalam

pelaksanaan

Unrealised gain

yang belum

on projects in

terealisasi

- 1.117.561.448

- 1.117.561.448 (1.117.561.448)

-

-

progress

Aset (Liabilitas)

Deferred tax

Pajak Tangguhan (2.455.142.764)

1.462.394.653

(67.416.803)

(1.060.164.914) 1.494.275.686

70.602.629

504.713.401

Assets (Liabilities)

Aset Pajak

Tangguhan

Consolidation

Konsolidasian -

Deferred

Neto

11.805.296.651

13.295.162.433

21.560.773.611

Tax Assets - Net

Manajemen berpendapat bahwa aset pajak

tangguhan dapat terpulihkan seluruhnya

terhadap penghasilan kena pajak dimasa yang

akan datang sebelum masa manfaat pajak

tersebut berakhir.

Management believes that deferred tax assets

can be utilized against future taxable income

before the utilization period of fiscal losses

expires.

Aset dan liabilitas pajak tangguhan, selain

akumulasi rugi fiskal, berasal dari perbedaan

metode atau dasar yang digunakan untuk

tujuan

pencatatan

menurut

pelaporan

akuntansi dan pajak, terutama terdiri dari

penyusutan aset tetap, cadangan kerugian

penurunan nilai, transaksi sewa guna usaha,

provisi bonus dan kesejahteraan karyawan.

Deferred tax assets and liabilities, other than

accumulated tax losses, arose from the

difference in the methods or basis used for

accounting and tax reporting purposes, mainly

comprising depreciation on property, plant and

equipment, allowance for impairment losses,

financial lease transaction and provision for

bonus and employees’ benefits.