79

The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2015 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2015 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

27. LIABILITAS IMBALAN KERJA (lanjutan)

27. EMPLOYMENT

BENEFIT

LIABILITES

(continued)

b. Imbalan Pensiun Manfaat Pasti (lanjutan)

b. Defined Benefit Pension Plan (continued)

Perusahaan (lanjutan)

The Company (continued)

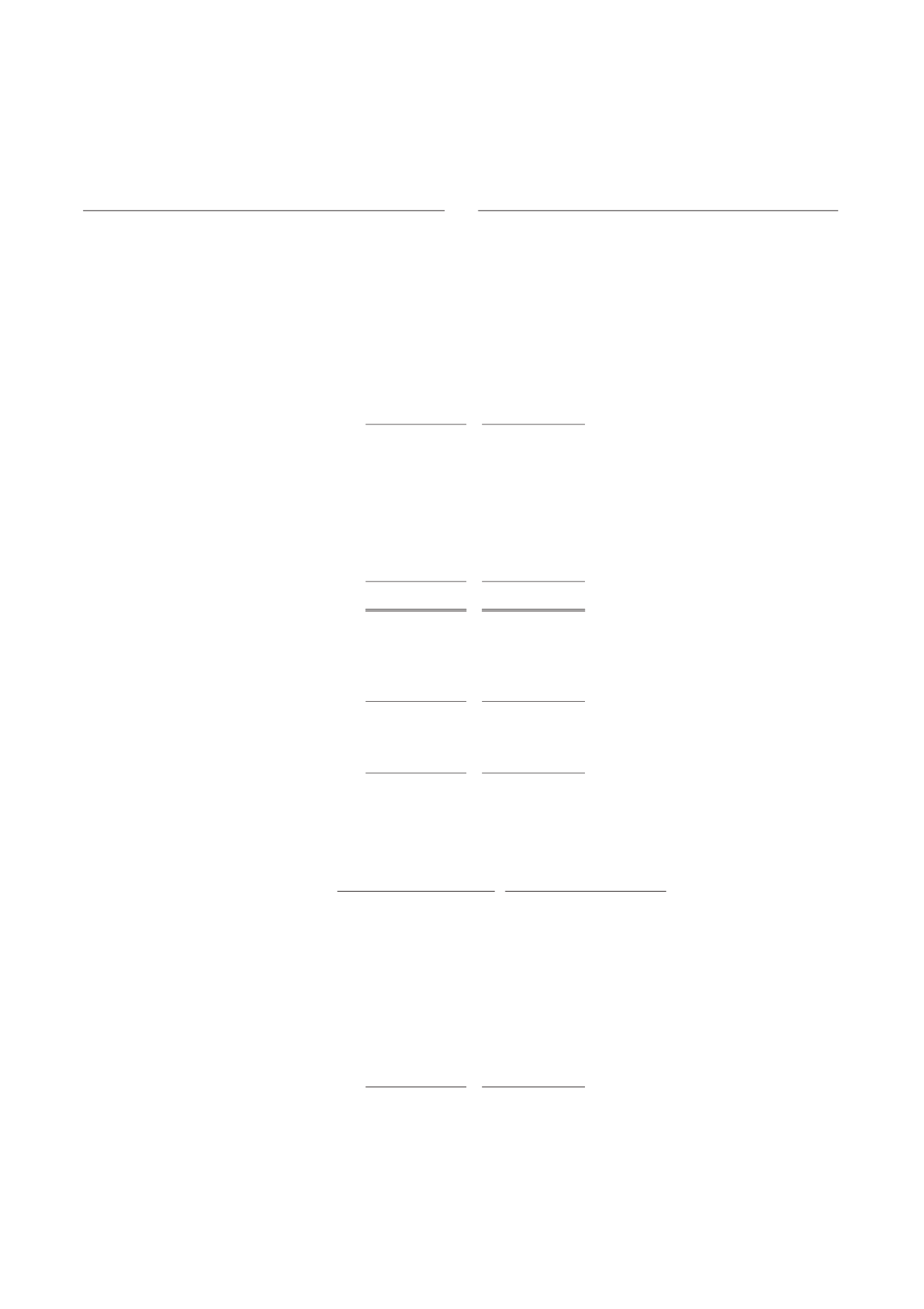

Mutasi atas nilai kini liabilitas imbalan pasti

masing-masing pada tanggal 31 Desember

2015 dan 2014 adalah sebagai berikut:

Present value defined benefit obligation

movement as of December 31, 2015 and 2014,

are as follows:

2015

2014

*)

Saldo awal

25.872.131.717 20.767.715.399

Beginning balance

Biaya jasa kini

1.892.436.096

2.112.752.671

Current service cost

Biaya bunga

2.019.369.230

1.717.756.102

Interest cost

Biaya jasa lalu

409.471.207

144.954.896

Past service cost

Biaya pesangon

340.484.495

241.615.265

Termination cost

Pembayaran imbalan kerja

(1.883.294.800) (2.495.519.401)

Benefit paid

Keuntungan/(kerugian)

Actuarial gain/(loss)

aktuaria atas:

arising from:

Perubahan asumsi finansial

(1.259.029.919)

824.482.893

Changes in financial assumption

Penyesuaian historis

(6.240.674.617)

2.558.373.892

Experience djustment

Saldo akhir

21.150.893.409 25.872.131.717

Ending balance

Jumlah yang diakui pada laba rugi adalah

sebagai berikut:

The amounts recognised in profit or loss are

as follows:

2015

2014

*)

Biaya bunga

2.019.369.230

1.717.756.102

Interest cost

Biaya jasa kini

1.892.436.096

2.112.752.671

Current service cost

Biaya jasa lalu

409.471.207

144.954.896

Past service cost

Biaya pesangon

340.484.495

241.615.265

Termination cost

Total

4.661.761.028

4.217.078.934

Total

Asumsi utama yang digunakan dalam

menentukan liabilitas imbalan pasca kerja

karyawan Perusahaan adalah sebagai berikut:

The principal assumptions used in determining

the Company’s post-employment benefits

liabilities are as follows:

2015

2014

Umur pensiun normal

50 Tahun/

Years

50 Tahun/

Years

Normal

retirement age

Suku bunga diskonto

9% pertahun/

per annum

8,1% pertahun/

per annum

Discount rate

Tingkat kenaikan gaji

6% pertahun/

per annum

6% pertahun/

per annum

Salaries increased rate

Tingkat mortalita

TMI'2011

TMI'2011

Mortality rate

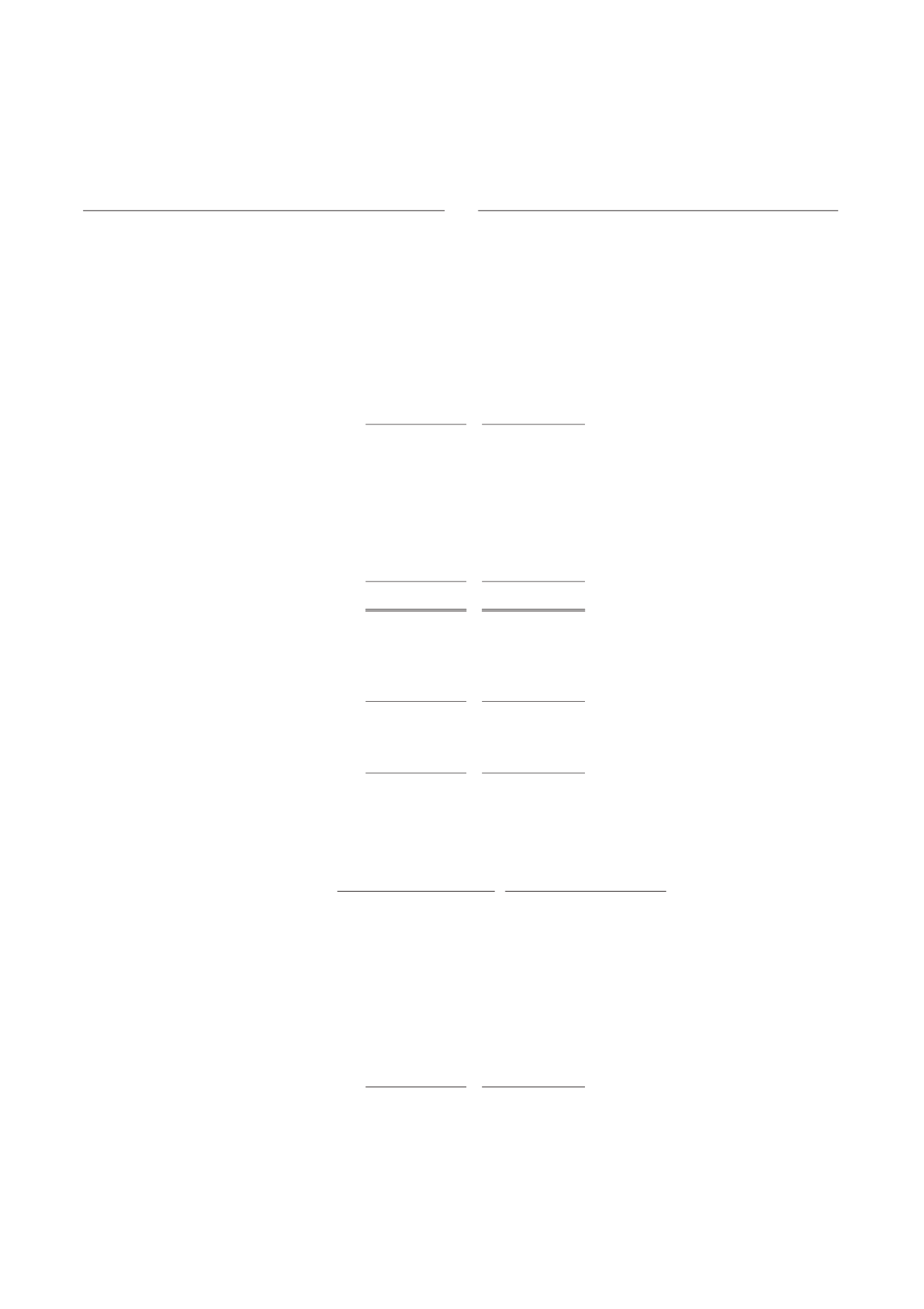

Entitas Anak

Subsidiaries

Tabel berikut ini merupakan ringkasan dari

kewajiban, dan mutasi saldo liabilitas imbalan

kerja.

The following table summarises the

obligations, expenses, and movement in the

employee benefit obligations

2015

2014

*)

Nilai kini liabilitas imbalan pasti

1.330.935.000

1.075.977.000

Present value of defined obligation

*) Disajikan kembali (Catatan 5)

*) As restated (Note 5)