70

The original consolidated financial statements included herein are in the

Indonesian language.

PT VOKSEL ELECTRIC Tbk DAN ENTITAS ANAK

CATATAN ATAS LAPORAN KEUANGAN

KONSOLIDASIAN

Tanggal 31 Desember 2015 dan

untuk tahun yang berakhir pada tanggal tersebut

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT VOKSEL ELECTRIC Tbk AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

As of December 31, 2015 and

for the year then ended

(Expressed in Rupiah, unless otherwise stated)

20. PERPAJAKAN (lanjutan)

20. TAXATION (continued)

d. Beban (Manfaat) Pajak (lanjutan)

d. Tax Expense (Benefit) (continued)

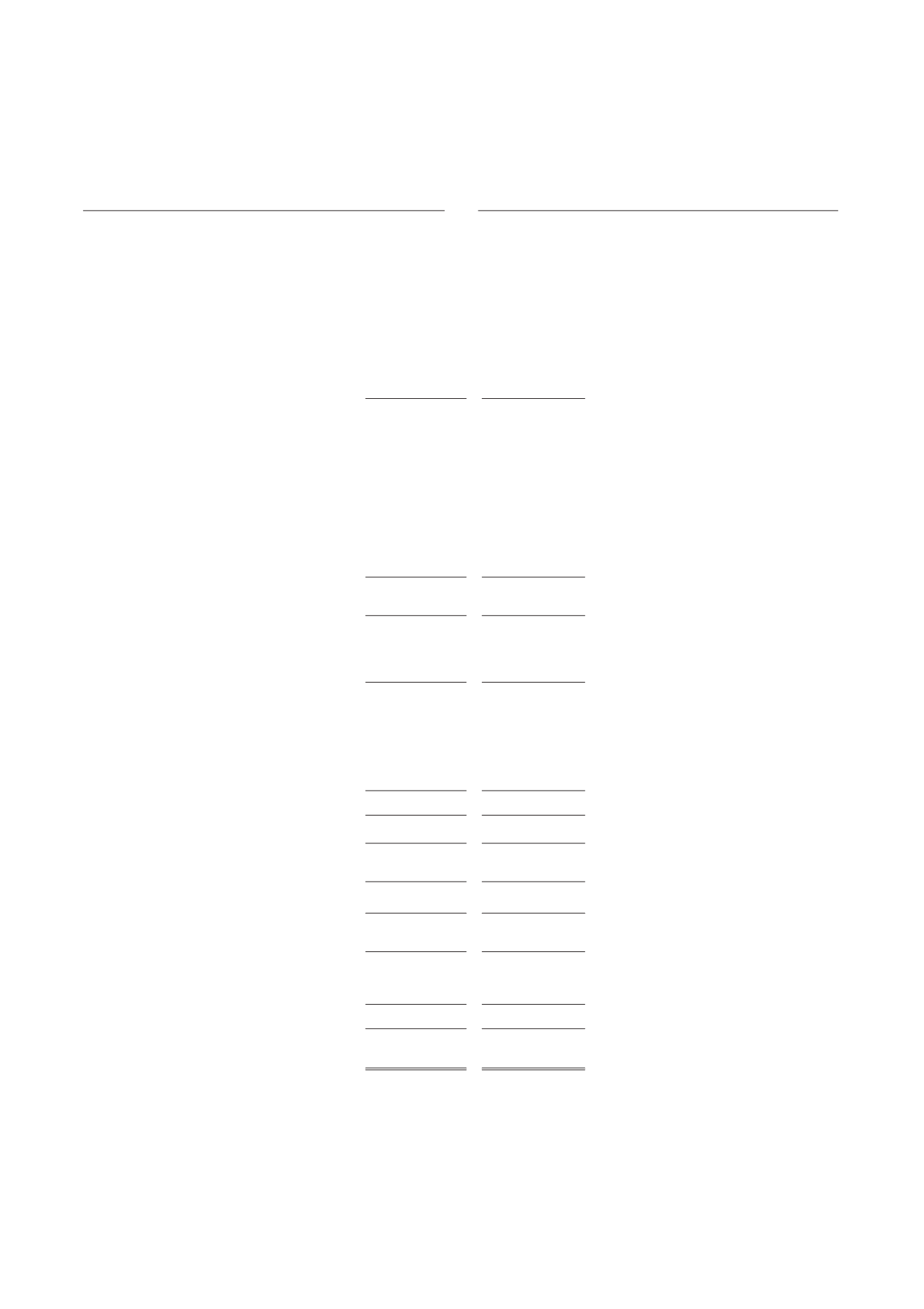

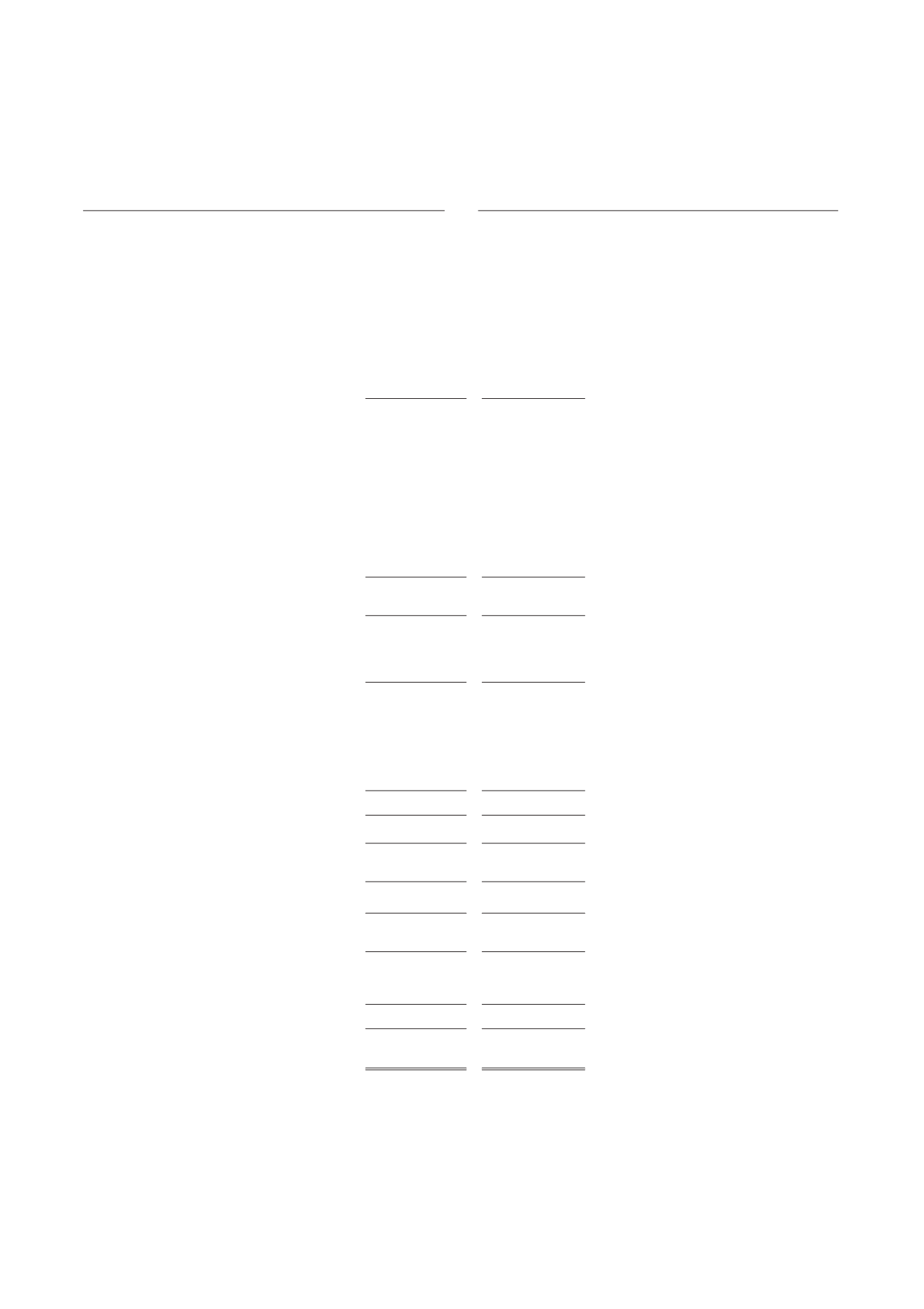

Rekonsiliasi antara laba (rugi) sebelum pajak

penghasilan menurut laporan laba rugi dan

penghasilan komprehensif lain konsolidasian

dengan taksiran laba (rugi) kena pajak

Perusahaan adalah sebagai berikut:

The reconciliation between profit (loss) before

tax reported in the consolidated statements of

profit or loss and other comprehensive

income with estimated taxable income (loss)

of the Company is as follows:

2015

2014

*)

Laba (rugi) sebelum taksiran pajak

Profit (loss) before estimated income tax

penghasilan menurut laporan laba

as of the consolidated statements

rugi dan penghasilan komprehensif

of profit or loss and other

lain konsolidasian

2.393.453.781 (115.213.886.095)

comprehensive income

Laba Entitas Anak sebelum taksiran

Income of Subsidiaries before

pajak penghasilan

(7.286.882.978) (3.942.097.986)

estimated income tax

Penyesuaian atas:

Adjustment of:

Penghasilan yang dikenakan pajak

Income subjected to final tax

final Entitas Anak

(18.146.826.259) (23.224.001.533)

of Subsidiaries

Beban yang dikenakan pajak final

Expenses subjected to final tax

Entitas Anak

16.570.424.365 21.123.850.422

of Subsidiaries

Penyesuaian konsolidasian

1.019.205.595

-

Consolidation adjustments

Rugi Perusahaan sebelum pajak

Loss before income tax-

penghasilan tidak final

(5.450.625.496) (121.256.135.192)

non final of the Company

Penyesuaian fiskal terdiri dari:

Fiscal adjustments consist of:

Beda tetap:

Permanent differences:

Beban yang tidak diperkenankan

96.256.648

892.883.753

Non-deductible expenses

Pendapatan bunga

(103.831.236)

(147.891.240)

Interest income

(7.574.588)

744.992.513

Beda temporer:

Temporary differences:

Imbalan kerja karyawan

2.778.466.228

1.721.559.533

Post employees' benefits

Penyusutan aset tetap

165.291.494

92.297.286

Depreciation of fixed assets

Sewa pembiayaan

357.266.485

192.153.329

Finance lease

Penyisihan penurunan nilai

Provision for impairment

piutang usaha

532.099.080

-

trade receivables

3.833.123.287

2.006.010.148

Taksiran rugi fiskal

(1.625.076.797) (118.505.132.531)

Estimated tax loss

Kompensasi rugi fiskal

Compensation fiscal loss

Tahun sebelumnya

(118.505.132.531)

-

carried forward

Total rugi fiskal Perusahaan

(120.130.209.328) (118.505.132.531)

Total fiscal losses of the Company

Taksiran Beban Pajak Kini

Estimated Corporate Income

Perusahaan

-

-

Tax Expenses

Pajak penghasilan dibayar dimuka

Prepaid income taxes

Pajak penghasilan pasal 22

(14.367.829.000) (30.438.254.837)

Income tax article 22

Pajak penghasilan pasal 25

(6.219.260.572) (2.199.449.562)

Income tax article 25

Jumlah pajak dibayar di muka

(20.587.089.572) (32.637.704.399)

Total prepaid taxes

Estimasi tagihan pajak

Estimated claims for tax

penghasilan Perusahaan

(20.587.089.572) (32.637.704.399)

refund of the Company

*) Disajikan kembali (Catatan 5)

*) As restated (Note 5)

Dalam laporan keuangan konsolidasian ini,

jumlah penghasilan kena pajak didasarkan

atas

perhitungan

sementara,

karena

Perusahaan belum menyampaikan Surat

Pemberitahuan Tahunan pajak penghasilan

badan.

In these consolidated financial statements,

the amount of taxable income is based on

preliminary calculations, as the Company has

not yet submitted its Annual Corporate

Income Tax Returns.